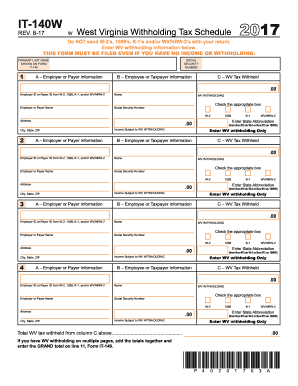

Get Wv Dor It-140w 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WV DoR IT-140W online

How to fill out and sign WV DoR IT-140W online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax documents can turn into a significant hurdle and major stressor without appropriate assistance provided.

US Legal Forms has been established as an online solution for WV DoR IT-140W e-filing and offers numerous advantages for taxpayers.

Press the Done button in the upper menu once you have completed it. Save, download, or export the filled-out form. Utilize US Legal Forms to ensure secure and straightforward completion of the WV DoR IT-140W.

- Locate the form on the website within the specific section or through the search engine.

- Press the orange button to access it and wait for it to load.

- Examine the form and focus on the instructions. If this is your first time completing the sample, adhere to the line-by-line guidance.

- Pay attention to the highlighted fields. These are fillable and need specific information to be entered. If you are unsure what to include, refer to the instructions.

- Always sign the WV DoR IT-140W. Utilize the built-in feature to create your e-signature.

- Select the date field to automatically insert the correct date.

- Review the document to make any necessary edits before submission.

How to modify Get WV DoR IT-140W 2017: personalize forms online

Complete and endorse your Get WV DoR IT-140W 2017 swiftly and without mistakes. Discover and modify, and endorse adaptable form templates in the ease of a single tab.

Your document process can be significantly more productive if everything you need for modification and managing the flow is organized in one location. If you are looking for a Get WV DoR IT-140W 2017 form example, this is the spot to acquire it and complete it without seeking external solutions. With this smart search engine and editing tool, you won’t need to search any further.

Simply enter the name of the Get WV DoR IT-140W 2017 or any other form and locate the appropriate template. If the example appears pertinent, you can commence modifying it immediately by clicking Get form. There is no need to print or even download it. Hover and press on the interactive fillable fields to input your information and endorse the form within a single editor.

Utilize additional editing tools to tailor your template:

Store the form on your device or convert its format to the one you need. When equipped with a clever forms archive and a robust document editing solution, managing documentation is simpler. Locate the form you seek, complete it instantly, and endorse it on the spot without downloading it. Simplify your paperwork routine with a solution designed for modifying forms.

- Select interactive checkboxes in forms by clicking on them.

- Review other sections of the Get WV DoR IT-140W 2017 form text by using the Cross, Check, and Circle tools.

- If you wish to add more text into the document, utilize the Text tool or insert fillable fields with the appropriate button. You can also define the content of each fillable field.

- Insert images into forms using the Image button. Upload images from your device or capture them with your computer camera.

- Include custom graphic elements to the document. Employ Draw, Line, and Arrow tools to annotate the document.

- Annotate over the text in the document if you wish to obscure it or emphasize it. Conceal text sections using the Erase, Highlight, or Blackout tools.

- Add custom elements like Initials or Date using the respective tools. They will be generated automatically.

Related links form

West Virginia state withholding tax refers to the amount deducted from an employee's paycheck to cover state income tax liabilities. Employers are responsible for withholding these taxes and submitting them to the state. Understanding how the WV DoR IT-140W interacts with withholding can help you maintain proper tax management.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.