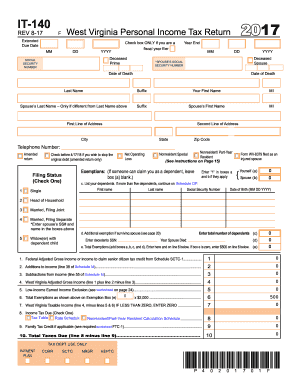

Get Wv Dor It-140 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WV DoR IT-140 online

How to fill out and sign WV DoR IT-140 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing a tax form can become a significant challenge and a major inconvenience if proper guidance is not provided.

US Legal Forms has been created as an online tool for WV DoR IT-140 e-filing and offers various advantages for taxpayers.

Utilize US Legal Forms to ensure secure and straightforward completion of the WV DoR IT-140.

- Locate the template on the site within the designated section or through the Search engine.

- Press the orange button to access it and wait for it to load.

- Examine the template and pay close attention to the instructions. If you have never filled out the template before, adhere to the step-by-step guidelines.

- Pay special attention to the highlighted fields. They are editable and require specific information to be entered. If you're uncertain about what information to provide, consult the instructions.

- Always sign the WV DoR IT-140. Use the built-in tool to create your e-signature.

- Choose the date field to automatically fill in the correct date.

- Review the document to make any necessary changes before e-filing.

- Click the Done button on the top menu when you have finished.

- Save, download, or export the completed template.

How to Adjust Get WV DoR IT-140 2017: Personalize Forms Online

Streamline your document creation process and tailor it to your specifications with just a few clicks. Complete and endorse Get WV DoR IT-140 2017 using an effective yet intuitive online editor.

Handling paperwork can be a hassle, especially when you manage it sporadically. It requires you to rigorously follow all regulations and accurately fill out all sections with thorough and exact information. However, it often occurs that you need to tweak the form or incorporate additional sections to fill in.

If you wish to enhance Get WV DoR IT-140 2017 before sending it, the simplest method is to utilize our all-inclusive yet easy-to-navigate online editing tools.

This robust PDF editing platform permits you to swiftly and effortlessly finalize legal documents from any device with internet access, make essential modifications to the template, and insert additional fillable sections. The service allows you to select a specific area for each type of information, such as Name, Signature, Currency, and SSN, and so forth. You can designate these fields as mandatory or conditional and determine who should fill in each section by assigning them to a specific recipient.

Our editor is a flexible multi-functional online tool that can assist you in swiftly and easily adapting Get WV DoR IT-140 2017 and other forms to suit your requirements. Minimize document preparation and submission time and enhance the quality of your paperwork without difficulties.

- Select the required template from the library.

- Complete the blanks with Text and apply Check and Cross tools to the checkboxes.

- Use the toolbar on the right side to modify the template with new fillable sections.

- Choose the sections based on the type of information you want to gather.

- Set these fields as mandatory, optional, or conditional and arrange their sequence.

- Designate each section to a specific individual using the Add Signer option.

- Review to ensure all necessary adjustments have been made and click Done.

Get form

West Virginia has not completely eliminated personal property taxes. However, there have been discussions about potential reforms to ease the burden on residents. Utilizing the WV DoR IT-140 allows you to report personal property effectively. It's vital to stay updated on legislative changes that may impact this tax.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.