Loading

Get Ca Ftb Schedule K-1 (568) Instructions 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB Schedule K-1 (568) Instructions online

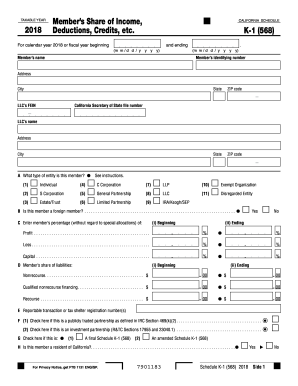

Completing the CA FTB Schedule K-1 (568) can be straightforward when you have the proper guidance. This document is essential for reporting income, deductions, and credits for members of a Limited Liability Company in California.

Follow the steps to efficiently fill out the Schedule K-1 (568) online.

- Use the ‘Get Form’ button to access the Schedule K-1 (568) form and open it in your online editor.

- Begin by entering the taxable year at the top of the form. Specify whether it is for the calendar year or fiscal year, and fill in the respective dates.

- Provide the member's name, identifying number, and address details accurately. Ensure that the LLC's FEIN and Secretary of State file number are also clearly filled out.

- Indicate the type of entity for the member by selecting the appropriate checkbox. Options include Individual, C Corporation, General Partnership, and others as listed.

- If applicable, specify whether the member is a foreign member by checking 'Yes' or 'No'.

- Enter the member's percentage of profit, loss, and capital at both the beginning and ending of the year.

- Fill in the member's share of liabilities on both starting and ending dates, including nonrecourse and recourse amounts.

- Complete any required fields related to reportable transactions or tax shelter registration numbers, if applicable.

- Proceed to the next sections, including the member’s capital account analysis and the details of their share of income, losses, and deductions.

- Review all the information entered for accuracy. Once confirmed, you can save the changes, download, print, or share the completed form.

Start filling out your CA FTB Schedule K-1 (568) online now for a smoother filing experience.

Related links form

If you are part of a limited liability company in California, you typically need to file form 568. This applies whether your LLC is doing business, has income, or even if it operates at a loss. To determine your specific filing requirements, it is advisable to consult the CA FTB Schedule K-1 (568) Instructions or a tax professional.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.