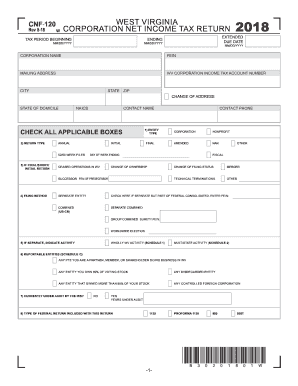

Get Wv Cnf-120 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WV CNF-120 online

How to fill out and sign WV CNF-120 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can turn into a major obstacle and a considerable headache if proper guidance is not provided.

US Legal Forms is designed as an online solution for WV CNF-120 e-filing and offers various advantages for taxpayers.

Utilize US Legal Forms to ensure a smooth and straightforward WV CNF-120 completion.

- Obtain the form on the website in the designated section or through the search engine.

- Click the orange button to open it and wait until it has loaded.

- Examine the form and pay attention to the instructions. If you have not filled out the sample before, adhere to the line-by-line directions.

- Concentrate on the highlighted fields. These are editable and require specific information to be entered. If you are uncertain about what information to provide, consult the guidelines.

- Always sign the WV CNF-120. Use the integrated tool to create the e-signature.

- Select the date field to automatically enter the correct date.

- Review the sample to make changes and finalize it before e-filing.

- Press the Done button in the top menu once you have finished it.

- Save, download, or export the finalized document.

How to alter Get WV CNF-120 2018: personalize forms online

Eliminate the clutter from your documentation routine. Uncover the most efficient method to locate, modify, and submit a Get WV CNF-120 2018.

The task of preparing Get WV CNF-120 2018 requires accuracy and attention, particularly for individuals who are not well-acquainted with such work. It's crucial to locate an appropriate template and populate it with the accurate details. With the right approach to managing paperwork, you can have all the tools at your disposal. It's simple to refine your editing process without acquiring additional expertise.

Identify the suitable example of Get WV CNF-120 2018 and complete it promptly without switching between your browser tabs. Explore more tools to personalize your Get WV CNF-120 2018 form in the editing environment.

While on the Get WV CNF-120 2018 page, simply click the Get form button to commence editing. Inject your information into the form directly, as all the vital tools are readily available here. The example is pre-configured, so the effort required from the user is minimal. Just utilize the interactive fillable areas in the editor to swiftly complete your documentation. Merely click on the form and navigate to the editor mode right away. Populate the interactive fields, and your file is ready to go.

Frequently, a minor mistake can spoil the entire form when it is filled out manually. Eliminate concerns about errors in your documentation. Discover the templates you need within moments and complete them electronically through an intelligent editing tool.

- Surround the document with additional text if necessary. Utilize the Text and Text Box tools to insert text in a distinct box.

- Incorporate pre-made visual components like Circle, Cross, and Check with the corresponding tools.

- If required, capture or upload images to the document using the Image tool.

- Should you need to sketch something in the document, utilize Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools to modify the text within the document.

- If you wish to add notes to specific sections of the document, click on the Sticky tool and place a remark wherever necessary.

Get form

Related links form

The minimum income for tax filing can vary based on several factors, including your age and filing status. Generally, if your income is above a specified threshold, you need to file taxes. For many, this threshold ranges around $12,400 for single filers, but referring to the WV CNF-120 will provide the most updated information. Always ensure you are aware of the latest requirements to avoid any issues.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.