Loading

Get Wi Pc-220 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the WI PC-220 online

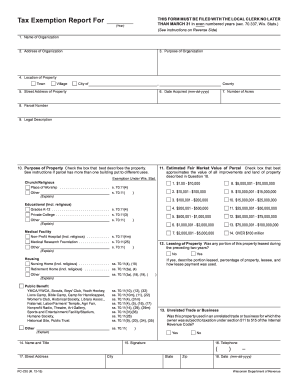

The WI PC-220 is an essential form for organizations seeking tax exemption for their properties in Wisconsin. This guide provides a step-by-step approach to filling out the form online, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to complete the WI PC-220 online.

- Press the ‘Get Form’ button to access the WI PC-220 form and open it in your preferred editing tool.

- In section 1, enter the name of the organization that owns the tax-exempt property.

- In section 2, input the address of the organization's administrative office or headquarters.

- Section 3 requires a brief statement of the primary purpose of the organization.

- For section 4, provide the tax district and county location of the exempt property.

- In section 5, enter the street address of the exempt property.

- Enter the date the property was acquired in section 6, using the format mm-dd-yyyy.

- In section 7, fill in the total number of acres the property encompasses.

- Section 8 requires the parcel number as found in the assessment roll.

- For section 9, input the legal description of the property as shown on the deed or assessment roll.

- In section 10, check the box that best describes the purpose or uses of the property.

- For section 11, select the box that approximately reflects the estimated fair market value of the property.

- Indicate in section 12 whether any part of the property was leased in the past two years, and provide necessary details.

- In section 13, indicate if the property was used for an unrelated trade or business that was taxable.

- In sections 14 to 18, provide the name, title, telephone number, address, signature, and date of the individual completing the form.

- After all sections are filled, save your changes. You can then download, print, or share the form as needed.

Complete your WI PC-220 form online today to ensure timely submission by March 31.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To qualify for the homestead credit, you generally need to occupy the property as your primary residence. Additionally, you must meet state-specific income limitations and residency requirements. If you're looking to understand these qualifications better, consulting resources such as WI PC-220 can provide essential information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.