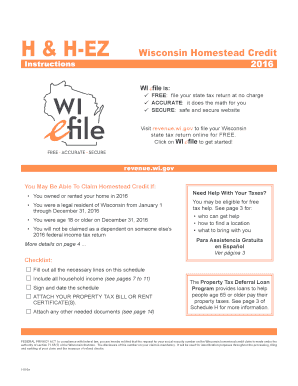

Get Wi I-016a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WI I-016a online

How to fill out and sign WI I-016a online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Submitting a tax form can become a significant issue and a major hassle if proper guidance is not provided.

US Legal Forms has been created as an online solution for WI I-016a electronic submission and offers numerous benefits for taxpayers.

Utilize US Legal Forms to ensure an easy and straightforward WI I-016a completion.

- Access the blank form online in the designated area or through the search engine.

- Click the orange button to open it and wait for it to load completely.

- Review the form and pay close attention to the guidelines. If you have never filled out the form before, adhere to the step-by-step instructions.

- Focus on the highlighted fields. They are fillable and require specific information to be provided. If you are unsure about what to enter, refer to the instructions.

- Always sign the WI I-016a. Utilize the built-in feature to create your electronic signature.

- Click the date field to automatically insert the current date.

- Review the form again to edit and adjust it before submitting.

- Hit the Done button in the top menu once you have completed it.

- Save, download, or export the filled form.

How to modify Get WI I-016a 2016: personalize forms digitally

Experience the convenience of the feature-rich online editor while finalizing your Get WI I-016a 2016. Utilize the array of tools to swiftly complete the fields and supply the necessary information immediately.

Drafting documents is laborious and costly unless you possess pre-prepared fillable forms to complete electronically. The most efficient method to tackle the Get WI I-016a 2016 is by leveraging our expert and versatile online editing services. We equip you with all essential tools for rapid form completion and allow you to make any modifications to your templates, tailoring them to specific requirements. Moreover, you can comment on the alterations and add notes for other stakeholders.

Here’s what you can accomplish with your Get WI I-016a 2016 in our editor:

Utilizing the Get WI I-016a 2016 in our advanced online editor is the fastest and most efficient method to handle, submit, and share your paperwork as needed from any location. The application operates from the cloud, enabling access from any internet-connected device. All templates you create or complete are safely stored in the cloud, ensuring you can always retrieve them when necessary and be confident of not losing them. Stop squandering time on manual document preparation and eliminate physical paperwork; transition everything online with minimal effort.

- Complete the blank fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize critical details with a preferred color or underline them.

- Conceal sensitive information using the Blackout function or simply eliminate them.

- Embed images to illustrate your Get WI I-016a 2016.

- Replace the original text with one that suits your requirements.

- Include comments or sticky notes to notify others about the updates.

- Add extra fillable fields and designate them to specific recipients.

- Secure the document with watermarks, date stamps, and bates numbers.

- Distribute the document in various formats and save it on your device or cloud upon completion.

Get form

Related links form

Filling out self-employment income requires you to accurately report your earnings and expenses to determine your taxable profit. You should keep detailed records and use forms designed for self-employed individuals. The WI I-016a can guide you in understanding how your self-employment income affects your overall tax obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.