Loading

Get Wi Dor Wt-7 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR WT-7 online

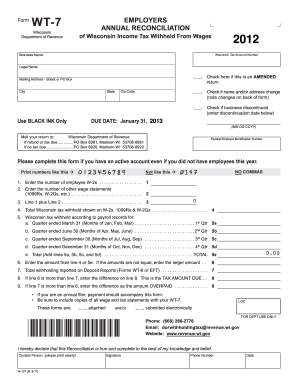

Filling out the Wisconsin Department of Revenue WT-7 form online is an essential task for employers reconciling their Wisconsin income tax withheld from wages. This guide will provide you with clear, step-by-step instructions to help you navigate through each section of the form with ease.

Follow the steps to successfully complete the WI DoR WT-7 form online.

- Click the ‘Get Form’ button to obtain the WT-7 form and open it in the editor.

- Enter your 15-digit Wisconsin Tax Account Number in the designated field. Ensure there are no dashes and that the number is accurate.

- Provide the Legal Name of your business as registered with the Wisconsin Department of Revenue.

- If this is an amended return, check the appropriate box. This informs the Department of Revenue that you are correcting a previously submitted form.

- Fill in the Mailing Address, ensuring to include the Street or PO Box, City, State, and Zip Code.

- Indicate any changes to your name or address by checking the relevant box. Note that you should describe these changes on the back of the form.

- If your business is discontinued, check the box and enter the discontinuation date in the field provided.

- Refer to the due date, which is January 31st of the year following the reconciliation, and ensure that you have the correct year selected.

- Begin entering data by indicating the number of employee W-2s and other wage statements, such as 1099Rs and W-2Gs.

- Follow through each line to report the total Wisconsin tax withheld as shown on your forms, entering information for each quarter ending as required.

- Complete the required calculations and enter the totals on the appropriate lines, checking that your amounts align correctly.

- At the end, make sure to print the completed form and sign it. Also, ensure you include any necessary wage and tax statements required.

- Finally, review all entered information for accuracy before saving your changes and deciding to download, print, or share your completed form.

Start completing your WI DoR WT-7 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A Wisconsin sales and use tax exemption certificate allows certain purchases to be made without paying sales tax. This certificate is often used by organizations that are exempt from sales tax liabilities. Knowing how this applies in your context can be beneficial, along with familiarity with related forms like the WI DoR WT-7.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.