Loading

Get Wi Dor Wt-7 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR WT-7 online

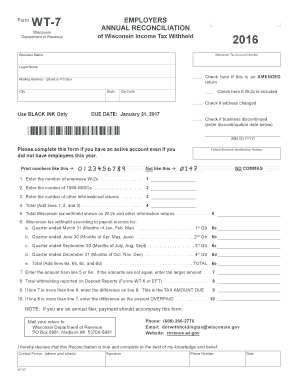

The WI DoR WT-7 is an essential form for employers in Wisconsin to report income tax withheld from employees. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the WI DoR WT-7 online with ease.

- Click the ‘Get Form’ button to obtain the WI DoR WT-7 form and access it for completion.

- Enter your 15-digit Wisconsin Tax Account Number in the designated field.

- Provide your Legal Name and Business Name as they appear on your official documents.

- Fill in your Mailing Address, including Street or PO Box, City, State, and Zip Code.

- Indicate whether this is an amended return by checking the appropriate box.

- If applicable, check the box to indicate that you are including a W-2c.

- If your address has changed, check the corresponding box to notify the authorities.

- Record your Federal Employer Identification Number in the specified field.

- Enter the number of employee W-2s, 1099-MISCs, and other informational returns in the given lines. Sum these numbers on the appropriate lines.

- Complete the lines detailing the total Wisconsin tax withheld indicated on W-2s and reports according to payroll records for each quarter.

- Calculate and enter the necessary amounts on the subsequent lines as directed, ensuring accuracy in reflecting total withholding and tax amounts due.

- Finally, review your entries for accuracy, print the completed form, and ensure you sign it before mailing.

Complete and submit your WI DoR WT-7 online today to fulfill your employer tax reporting obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you need to find your Wisconsin tax number, review previous tax documents or correspondence from the Wisconsin Department of Revenue. This number may also be included on your business registration forms. If you still have difficulty, contacting the Wisconsin DoR through their customer service can help you retrieve your number efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.