Loading

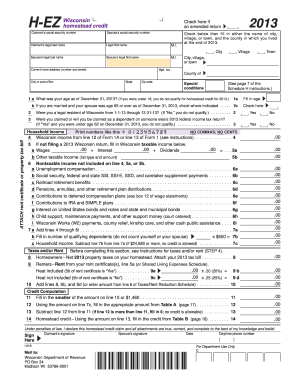

Get Wi Dor Schedule H-ez 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR Schedule H-EZ online

Getting started with the WI DoR Schedule H-EZ can seem daunting, but this guide will walk you through each step carefully to ensure a smooth online filing process. You can easily complete your form and ensure that all necessary information is accurately submitted.

Follow the steps to fill out the form correctly.

- Click 'Get Form' button to obtain the form and open it in the editor. Make sure to print or type all requested information clearly.

- Fill in your claimant information. This includes your social security number, legal name, and your current home address. Ensure that the details correlate with official documents.

- Answer the eligibility questions regarding age, residency in Wisconsin, and dependency status as of December 31, 2013. Your answers will determine your qualification for the homestead credit.

- Provide your household income information as required in the appropriate fields. This includes both taxable and nontaxable income, and you'll need to attach relevant income documentation if necessary.

- Complete the taxes and/or rent section depending on whether you are a homeowner or a renter. You will need specific amounts from your property tax bill or rent certificates.

- Compute your homestead credit by filling out the required lines as directed, using Tables A and B in the instructions for calculation.

- Sign and date your Schedule H-EZ. If married, ensure your spouse signs as well. Follow any additional assembly instructions provided in the official guidelines.

- You can now save your changes, download, print, or share the completed form as needed.

Complete your WI DoR Schedule H-EZ online today to take advantage of the homestead credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out the EZ tax form involves providing your basic information and income details. The form is designed to be user-friendly and straightforward. For those applying for tax credits, the WI DoR Schedule H-EZ serves as an excellent tool, allowing you to report necessary information clearly and easily for quicker processing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.