Get Wi Dor S-211 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

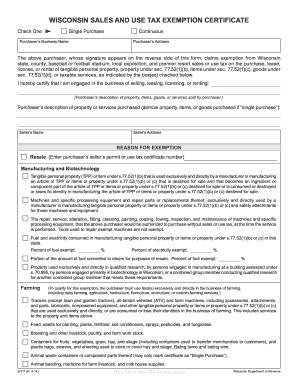

Tips on how to fill out, edit and sign WI DoR S-211 online

How to fill out and sign WI DoR S-211 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can turn into a significant obstacle and severe frustration if the correct guidance is not offered. US Legal Forms has been developed as an online tool for WI DoR S-211 electronic submission and offers several benefits for taxpayers.

Utilize the instructions on how to complete the WI DoR S-211:

Use US Legal Forms to ensure a secure and straightforward process for filling out the WI DoR S-211.

Access the blank form online in the relevant section or through the Search engine.

Press the orange button to open it and wait for it to finish loading.

Examine the form and pay attention to the guidelines. If this is your first time filling out the template, follow the detailed step-by-step instructions.

Focus on the yellow fields. These are editable and require specific details to be filled in. If you are unsure about what information to provide, refer to the guidelines.

Always sign the WI DoR S-211. Utilize the built-in function to create your electronic signature.

Click on the date field to automatically populate the current date.

Review the form to make any necessary edits before submitting.

Hit the Done button in the top menu once you have finalized it.

Save, download, or export the completed document.

How to Modify Get WI DoR S-211 2014: Personalize Forms Online

Locate the appropriate Get WI DoR S-211 2014 template and adjust it on the spot.

Streamline your documentation with an intelligent document modification solution for web-based forms.

Your daily operations with documents and forms can be enhanced when you have all the necessary resources in a single location. For instance, you can discover, acquire, and modify Get WI DoR S-211 2014 in merely one browser tab.

If you require a specific Get WI DoR S-211 2014, it is effortless to locate it using the intelligent search function and access it immediately. You aren't required to download it or seek a separate editor to alter it and insert your information. All the tools for productive work come in just one comprehensive solution.

Make additional customized modifications with the available tools.

- This editing solution allows you to alter, complete, and sign your Get WI DoR S-211 2014 form directly on the spot.

- After locating a suitable template, click on it to access the editing mode.

- Once you open the form in the editor, all the necessary tools are readily available.

- It is straightforward to fill in the designated fields and delete them if necessary using a simple yet versatile toolbar.

- Implement all adjustments immediately, and sign the form without leaving the tab by just clicking the signature area.

Get form

Exceptions to the underpayment penalty in Wisconsin can include circumstances where a taxpayer's income fluctuates significantly, or when they can demonstrate reasonable cause for underpayment. Knowing these exceptions is vital for compliance and financial planning. The WI DoR S-211 offers detailed explanations of the qualifications for these exceptions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.