Loading

Get Wi Dor Pw-2 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR PW-2 online

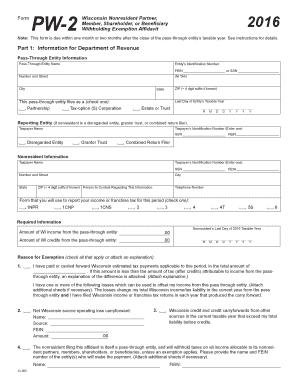

The WI DoR PW-2 is a crucial form for nonresident partners, members, shareholders, or beneficiaries seeking withholding exemptions in Wisconsin. This guide provides clear instructions on how to complete the form online, ensuring you understand each section and field.

Follow the steps to complete the form accurately and efficiently.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with Part 1 by providing the information for the Department of Revenue. Fill in the pass-through entity's name, identification number (either FEIN or SSN), address, and city or state details.

- For the pass-through entity type, check the appropriate box: Tax-option (S) Corporation, Partnership, or Estate/Trust. Indicate the last day of the entity's taxable year in the provided fields.

- Enter your identification information in the Nonresident Information section—include your name, identification number, and address. Make sure to provide contact details for further communication.

- Specify the form you will use to report income or franchise tax during this period by checking the relevant box in the Required Information section.

- Fill out the amounts for Wisconsin income and credits from the pass-through entity. Provide your exemptions with appropriate explanations when necessary.

- In Part 2, declare your request for an exemption from withholding by signing the affidavit. Provide your name and additional details required in this section.

- If you want to allow a third party to discuss this return with the department, complete the designee’s name and phone number fields. Otherwise, proceed to the signature section.

- After signing, specify the mailing address where the Department of Revenue should return Part 2 of your form. Ensure it is typed or printed legibly.

- Finally, review all information to ensure accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your documents online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out the employee's Wisconsin withholding exemption certificate requires you to accurately assess your tax status. You can find the WI DoR PW-2 form online, which provides explicit guidelines on how to complete it. Ensure that all information is correct, as this will help you avoid any issues with withholding in the future.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.