Get Wi Dor 1-es (d-101) 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

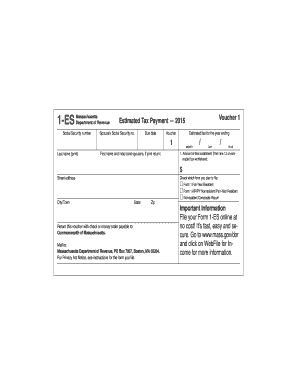

Tips on how to fill out, edit and sign WI DoR 1-ES (D-101) online

How to fill out and sign WI DoR 1-ES (D-101) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can turn into a major hurdle and severe annoyance if appropriate help is not provided. US Legal Forms has been created as an online solution for WI DoR 1-ES (D-101) electronic filing and presents various advantages for taxpayers.

Utilize the suggestions on how to complete the WI DoR 1-ES (D-101):

Leverage US Legal Forms to guarantee easy and straightforward filling of the WI DoR 1-ES (D-101).

- Find the template on the website within the specified section or through the search engine.

- Click the orange button to access it and wait for it to load.

- Review the form and adhere to the instructions. If you have not previously filled out this template, follow the step-by-step instructions.

- Focus on the highlighted fields. They are editable and require specific information to be entered. If you are uncertain about what details to include, refer to the guidelines.

- Always sign the WI DoR 1-ES (D-101). Utilize the integrated tool to create your electronic signature.

- Press the date field to automatically insert the appropriate date.

- Revisit the template to review and modify it prior to electronic submission.

- Select the Done button in the upper menu once you have completed the task.

- Save, download, or export the finalized form.

How to modify Get WI DoR 1-ES (D-101) 2012: personalize forms online

Experience a hassle-free and digital method of adjusting Get WI DoR 1-ES (D-101) 2012. Utilize our reliable online service and save considerable time.

Creating every form, including Get WI DoR 1-ES (D-101) 2012, from the ground up requires excessive effort, so utilizing a proven solution of pre-prepared document templates can work wonders for your efficiency.

However, editing them can pose a difficulty, particularly with files in PDF format. Fortunately, our extensive library includes a built-in editor that enables you to seamlessly complete and modify Get WI DoR 1-ES (D-101) 2012 without leaving our site, thus avoiding hours spent on paperwork. Here's how to work with your file using our tools:

Whether you need to manage editable Get WI DoR 1-ES (D-101) 2012 or any other form available in our collection, you are on the right path with our online document editor. It's simple and secure and doesn’t require any special technical expertise. Our web-based tool is designed to handle almost everything imaginable regarding document editing and execution.

Forget about traditional methods of handling your documents. Opt for a more effective solution to assist you in streamlining your responsibilities and making them less reliant on paper.

- Step 1. Find the required document on our website.

- Step 2. Click Get Form to launch it in the editor.

- Step 3. Utilize professional editing tools that permit you to insert, delete, annotate, and emphasize or censor text.

- Step 4. Create and add a legally-binding signature to your document by selecting the sign option from the main toolbar.

- Step 5. If the form layout does not appear as desired, use the tools on the right to delete, add additional pages, and rearrange them.

- Step 6. Add fillable fields so other individuals can be invited to complete the form (if applicable).

- Step 7. Share or distribute the form, print it, or choose the format in which you would like to receive the document.

Get form

You can pick up Wisconsin tax forms at various locations, such as local government offices or tax preparers. However, the most efficient way is to go online to the Wisconsin Department of Revenue. They offer downloadable forms, including the essential WI DoR 1-ES (D-101). This saves time and ensures you have the right documents.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.