Get Wa Dor Combined Excise Tax Return 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA DoR Combined Excise Tax Return online

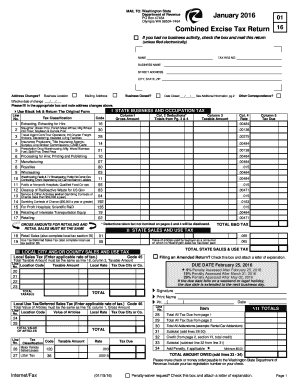

Completing the WA DoR Combined Excise Tax Return online is essential for businesses operating in Washington State to ensure compliance with tax regulations. This guide provides clear and supportive instructions to help users navigate each section of the form effectively.

Follow the steps to complete the online tax return easily.

- Press the ‘Get Form’ button to access the Combined Excise Tax Return form and open it for editing.

- Begin filling in your business information in the designated fields: enter your name, tax registration number, business name, street address, city, state, and ZIP code. Ensure accuracy to prevent processing delays.

- Indicate any address changes if necessary by checking the appropriate box and providing the effective date of the change.

- If your business is closed, check the 'Business Closed?' box and enter the date of closure.

- For the business and occupation tax section, fill out the gross amount for each tax classification that applies to your business activities. Be precise and consult the rates provided for each category.

- In the deductions section, provide details for allowable deductions related to your reporting activity. Ensure to include any deductions on the corresponding pages to validate your claim.

- Complete the sales and use tax portion by entering the retail sales tax applied to your transactions and any applicable local sales tax rates as directed.

- Review and complete any additional tax sections that apply to your business, including lodging taxes and other relevant taxes as specified in the document.

- After all fields have been accurately filled out, review the entire form for errors before finalizing.

- Once satisfied with your entries, save the changes. You can then download, print, or share the completed form as needed.

Start completing your WA DoR Combined Excise Tax Return online today to ensure compliance and avoid penalties.

Get form

Excise taxes may be deductible under certain circumstances on your federal tax return. Typically, these deductions relate to business expenses rather than personal taxes. Understanding the nuances of the WA DoR Combined Excise Tax Return and federal guidelines is important for accurate reporting. It is advisable to consult a tax professional to maximize your deductions effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.