Loading

Get Vt Schedule In-113 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Schedule IN-113 online

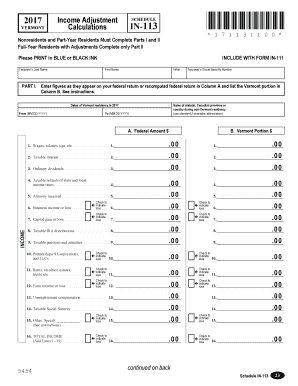

This guide provides a clear and straightforward approach to completing the VT Schedule IN-113 online. Whether you are a nonresident, part-year resident, or full-year resident with income adjustments, this resource will help you through each section of the form, ensuring that you provide the necessary information accurately.

Follow the steps to fill out the VT Schedule IN-113 online.

- Use the ‘Get Form’ button to access the VT Schedule IN-113 and initiate the online form-filling process.

- In the first section, enter your federal income figures as they appear on your federal return in Column A. For Column B, specify the Vermont portion of each income category. Be sure to accurately follow the form's structure while filling out the amounts.

- If you are a nonresident or part-year resident, provide your dates of Vermont residency in the designated areas, indicating both the start and end dates using the format MM DD YYYY.

- When you reach the income line items, input the total amounts for each category, such as wages, dividends, and rental income. If applicable, mark any losses in the corresponding boxes.

- For adjustments to income, fill out the relevant fields based on your federal tax return. This includes deductions for various expenses such as health savings accounts and moving expenses.

- Continue through the form, ensuring that all amounts are documented and that you have checked off any losses where required.

- Once you have completed both parts of the form, review your entries for accuracy. Then, save your changes before proceeding to download or print the form.

- Finally, once all information is verified, download, print, or share your completed VT Schedule IN-113 as necessary, ensuring compliance with any filing requirements.

Complete your documents online to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The VT Schedule IN-113 is a specific tax form used in Vermont designed for seniors to apply for property tax credits. This schedule helps eligible seniors claim benefits that reduce their property tax liabilities. It’s recommended to consult this form when planning your taxes to take full advantage of potential savings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.