Loading

Get Vi 720-b 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VI 720-B online

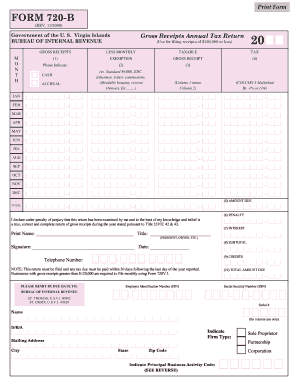

Filing the VI 720-B is an essential step for businesses in the U.S. Virgin Islands with gross receipts of $120,000 or less. This guide provides a clear and comprehensive process for filling out the online form, ensuring that you accurately report your gross receipts and comply with tax obligations.

Follow the steps to complete your VI 720-B form effectively.

- Press the ‘Get Form’ button to access the VI 720-B form and open it in the editing interface.

- Fill in the year for which you are filing the return at the top of the form. This indicates the tax year being reported.

- Enter your gross receipts for each month in the designated columns. Make sure to document all applicable months with complete figures.

- In the exemption column, indicate any exemptions that apply to your business. Examples include bank income and commissions from lottery ticket sales.

- Calculate the taxable amount by subtracting any exemptions from the gross receipts for each month.

- Multiply the total taxable amount by 4% to determine the tax due for the year. Enter this figure in the appropriate field.

- Complete the declaration portion by affirming the correctness of your submission. Include your printed name, title, and signature.

- Fill in your contact information, including your telephone number and mailing address.

- Review all entries for accuracy, ensuring that totals are correctly calculated.

- Once completed, save changes to the form, and choose to download, print, or share it as necessary.

Complete your VI 720-B form online to stay compliant with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If your restaurant provides health coverage to employees, you may need to file Form 720 to report PCORI fees. Ensuring compliance is essential for your business operations. Utilizing the U.S. Legal Forms platform and the VI 720-B form will help clarify your filing obligations and keep your restaurant on track.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.