Get Va St-11a 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the VA ST-11A online

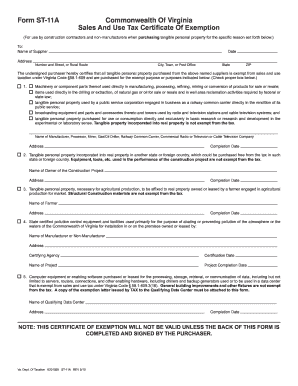

Filling out the VA ST-11A form online can streamline the process of certifying sales and use tax exemption for construction contractors and non-manufacturers. This comprehensive guide provides clear, step-by-step instructions to ensure you complete the form correctly and efficiently.

Follow the steps to complete the VA ST-11A form online

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- In the first section, enter the 'Name of Supplier' and their 'Address,' including number and street or rural route, city, town or post office, state, and ZIP code. Ensure all information is accurate and complete.

- In the next section, check the appropriate box corresponding to the exempt purpose for which you are purchasing tangible personal property. Each purpose should be reviewed carefully to ensure it fits your situation.

- Provide the name and address of the relevant parties involved for each selected exempt purpose. This includes the 'Name of Manufacturer, Processor, Miner, Gas/Oil Driller, or Railway Common Carrier,' along with their address and completion date.

- Ensure the back of the form is completed and signed by the purchaser. Include the 'Name of Purchaser,' 'Address,' and 'Trading Date.' The signature must be filled out, confirming authorization and truthfulness of the information provided.

- Review the information entered for accuracy. Make any necessary corrections before finalizing the form.

- Once confirmed, options are available to save changes, download, print, or share the completed form as needed.

Complete your VA ST-11A form online today for a smooth certification process.

Related links form

Finding your sales tax number is typically easy; you can locate it on documents issued by the Virginia Department of Taxation or through your business account online. If you cannot find it, consider contacting the tax department directly for assistance. Having this number on hand is crucial for compliance with sales tax regulations. Always ensure it aligns with your VA ST-11A understanding to protect your business's financial interests.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.