Get Va Form Rdc 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

This guide provides a step-by-step approach to completing the Virginia Form RDC for the Research and Development Expenses Tax Credit online. Whether you are an experienced filer or new to tax credits, this comprehensive guide will assist you in navigating the form with ease.

Follow the steps to successfully complete the VA Form RDC online.

- Click 'Get Form' button to obtain the VA Form RDC and open it in the editor for online filling.

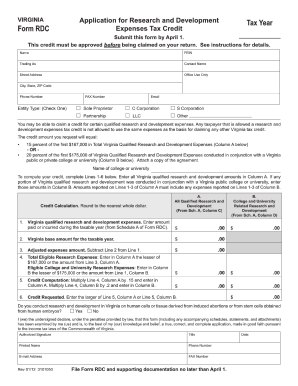

- Enter your name, FEIN (Federal Employer Identification Number), and the name your business is trading as. Fill in your contact name, street address, city, state, ZIP code, phone number, fax number, and email.

- Select your entity type by checking one of the available options (sole proprietor, C corporation, S corporation, partnership, LLC, or other).

- Provide details regarding your research and development expenses. Complete Lines 1-3 in Column A with your Virginia qualified research and development expenses for the taxable year.

- If applicable, enter the amounts related to any Virginia public or private college or university in Column B.

- Complete additional fields to calculate your credit. Round the calculated amount to the nearest whole dollar.

- Finish by entering your signature, title, printed name, and date at the end of the form. Make sure to review all entered details for accuracy before finalizing.

- Once you have filled out the entire form, you can save your changes, download it for printing, or share it as required.

Start completing your VA Form RDC online today to ensure timely submission by April 1.

Get form

The 25 25 rule for the R&D credit means that businesses can claim up to 25% of their total qualified R&D expenses for the current year, based on prior year expenses. This rule allows companies to benefit from their previous investment while incentivizing ongoing R&D efforts. Understanding how this rule applies can enhance your credit claim. Utilize the VA Form RDC for clear guidelines on documenting your eligible expenses.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.