Loading

Get Va Form Rdc 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

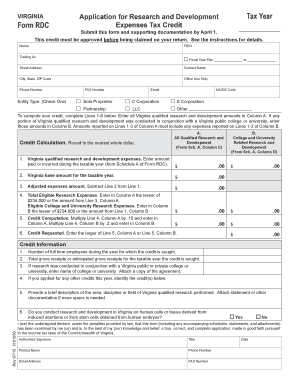

This guide provides detailed instructions on filling out the VA Form RDC, which is necessary for applying for the Research and Development Expenses Tax Credit in Virginia. Completing this form accurately can help ensure that your tax credit application is processed efficiently.

Follow the steps to successfully complete the VA Form RDC online

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter the tax year for which you are claiming the credit at the top of the form. Make sure to include the correct year to avoid delays.

- Fill in your entity name, FEIN, and trading name in the designated fields. This information is essential for identifying your application.

- Select the entity type by checking the appropriate box. Options include sole proprietor, corporation, partnership, LLC, and others.

- Provide your street address, city, state, and ZIP code to ensure your application is correctly routed.

- Complete the credit calculation section by entering your qualified research and development expenses in Column A and any amounts related to Virginia public colleges or universities in Column B.

- Fill in Lines 1 through 6 according to the instructions provided. Ensure accurate calculations to reflect the eligible amounts.

- Answer the credit information questions, providing details about full-time employees, gross receipts, and any related colleges or universities.

- Sign and date the form in the designated area to validate your application.

- Review your entries for accuracy, then save your changes, download, print, or share your completed form as necessary.

Complete your VA Form RDC online today to apply for your tax credit!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Recording an R&D tax credit involves documenting the credit within your financial records. Use your tax return to indicate the amount claimed, and maintain detailed records of eligible expenses supported by receipts and related documents. Completing the VA Form RDC provides a structured approach to ensure everything is accurately logged.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.