Get Va Form Rdc 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

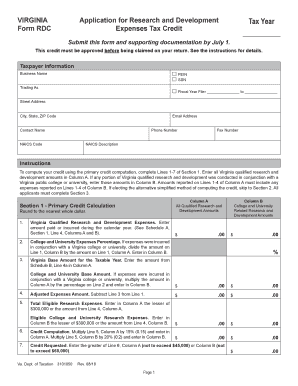

The VA Form RDC is an essential document for claiming the Research and Development Expenses Tax Credit in Virginia. This guide will provide you with step-by-step instructions on how to fill out the form online effectively.

Follow the steps to fill out the VA Form RDC online.

- Click ‘Get Form’ button to obtain the form and open it in an accessible editor.

- Begin by entering your taxpayer information, including your business name, federal employer identification number (FEIN), and social security number (SSN) in the designated fields.

- Provide your trading name, fiscal year, street address, city, state, ZIP code, email address, contact name, NAICS code, phone number, and fax number.

- For Section 1, complete Lines 1-7 to compute your credit. Enter all Virginia qualified research and development amounts in Column A and any amounts conducted with a Virginia institution in Column B.

- Proceed to Section 2 if you are electing the alternative simplified method. Enter the total adjusted calendar year-qualified research and development expenses as instructed.

- Continue to Section 3 to provide additional credit information, such as the number of full-time employees and gross receipts for the year. Input research collaboration details if applicable.

- Once all sections are filled, ensure all required enclosures, such as schedules and agreements, are included, then save your changes.

- Finally, you can download, print, or share the completed form as needed.

Complete your VA Form RDC online today to efficiently apply for your research and development expenses tax credit.

Get form

To calculate the R&D tax credit, begin by identifying all qualifying research expenditures, which may include wages, materials, and other direct expenses. Then, apply the appropriate credit rate to these costs, which can vary based on specific tax regulations. Using the VA Form RDC can help you break down each expense accurately. A well-organized calculation process helps ensure you receive the maximum allowable credit.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.