Loading

Get Va Dot Va-4p Instructions 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT VA-4P Instructions online

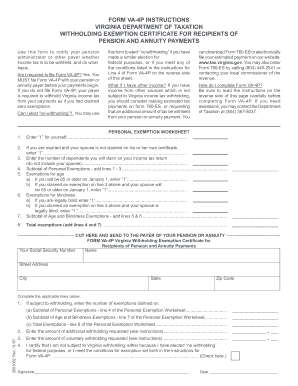

Filling out the VA DoT VA-4P form is essential for recipients of pension and annuity payments to notify their payer about income tax withholding preferences. This guide will walk you through the steps to successfully complete the form online.

Follow the steps to complete the VA DoT VA-4P Instructions.

- Press the ‘Get Form’ button to access the VA DoT VA-4P form and open it in your preferred application.

- Begin by entering your personal details, including your name, Social Security number, street address, city, state, and zip code in the designated fields.

- Proceed to complete the Personal Exemption Worksheet. Start by entering '1' for yourself on line 1, and if applicable, enter '1' for your spouse on line 2 if they are not claimed on their own certificate.

- Enter the number of dependents you will claim on your tax return on line 3, ensuring you do not include your spouse.

- For age exemptions, on line 5(a), if you will be 65 or older by January 1, enter '1'. If your spouse is also 65 or older, enter '1' on line 5(b).

- For blindness exemptions, complete line 6(a) if you are legally blind and line 6(b) if your spouse is legally blind.

- Calculate the subtotal of personal exemptions on line 4 and the subtotal of age and blindness exemptions on line 7.

- On line 8, add lines 4 and 7 to find your total exemptions.

- Return to the main form, enter the total exemptions in line 1 as directed, and complete lines 2 and 3 if you wish to have additional withholding.

- If you are not subject to Virginia withholding, check the box on line 4. Ensure you understand the conditions outlined in the instructions.

- Finally, sign and date the form, cut along the indicated line, and submit it to your pension or annuity payer.

Complete your VA DoT VA-4P form online today to ensure your withholding preferences are accurately communicated.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Claiming yourself on the VA 4 form can affect your tax withholding and overall tax situation. If you are filing your taxes with no dependents, it may be beneficial to claim yourself. Doing so increases your exemption, thereby reducing tax withholding. For a more precise decision, refer to the VA DoT VA-4P Instructions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.