Get Va Dot Va-4 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT VA-4 online

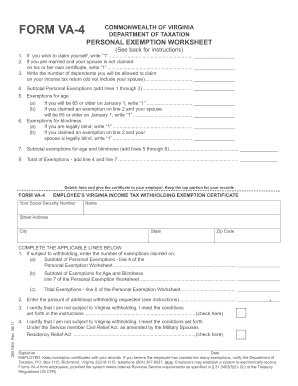

Filling out the VA DoT VA-4 form is an essential step for individuals seeking to inform their employers about their Virginia income tax withholding exemptions. This guide provides clear, step-by-step instructions to navigate the form efficiently, ensuring users can complete it accurately.

Follow the steps to fill out the VA DoT VA-4 online effectively.

- Click the ‘Get Form’ button to access the form and open it in your editing interface.

- Enter your Social Security number in the designated field at the top of the form.

- Fill in your name, street address, city, state, and zip code in the provided spaces.

- Complete the Personal Exemption Worksheet by following these subsections: 1. Indicate ‘1’ if you wish to claim yourself. 2. Indicate ‘1’ for your spouse if they are not claimed on another certificate. 3. Specify the number of dependents you are allowed to claim on your income tax return.

- Calculate your subtotal personal exemptions by adding the amounts from the previous lines and enter the total.

- For exemptions related to age, indicate ‘1’ if you will be 65 or older by January 1 on Line 5(a). If your spouse will also be 65 or older, mark ‘1’ on Line 5(b).

- For blindness exemptions, indicate ‘1’ on Line 6(a) if you are legally blind. If your spouse is blind, also mark ‘1’ on Line 6(b).

- Add the subtotals for age and blindness, and enter the total amount.

- Calculate the Total of Exemptions by adding line 4 and line 7.

- In the next section, report your exemptions: 1. Enter the subtotal of personal exemptions (line 4). 2. Enter subtotal exemptions for age and blindness (line 7). 3. Enter the total exemptions (line 8).

- If you wish to request additional withholding, indicate the amount in the appropriate field.

- Check the box if you certify that you are not subject to Virginia withholding under the relevant conditions, or check the second box if you are exempt as per the Servicemember Civil Relief Act.

- Sign and date the form at the bottom once all fields are completed.

- Save your changes, and download or print the completed form for your records. Provide the exemption certificate portion to your employer.

Complete your VA DoT VA-4 form online today and ensure your tax exemptions are accurately documented.

Submitting an intent to file in Virginia is a key step in managing your tax responsibilities. You can complete this process online or by mail, depending on your preference. Ensure you provide all required documentation to avoid delays. For a smooth experience, consider using platforms like uslegalforms that offer tools to assist you with compliance and submission.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.