Loading

Get Va Dot St-9 & St-9a 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT ST-9 & ST-9A online

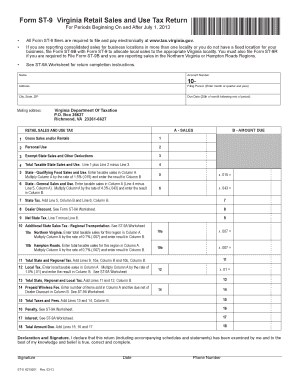

Filling out the VA DoT ST-9 and ST-9A forms online can streamline the process of reporting retail sales and use tax in Virginia. This comprehensive guide provides clear, step-by-step instructions to ensure that you complete the forms accurately and efficiently.

Follow the steps to complete your VA DoT ST-9 & ST-9A forms online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and account number in the designated fields. Ensure that you provide the correct information to avoid processing delays.

- Fill in your address, including city, state, and ZIP code. This information is crucial for timely communication from the Virginia Department of Taxation.

- Specify the filing period by entering the month or quarter and the corresponding year.

- State the due date, which is the 20th of the month following the end of the filing period.

- In section A - Sales, start by entering your gross sales and/or rentals on Line 1. This amount should not include any sales tax.

- For Line 2, record the cost price of any personal use items taken from inventory. This section helps account for taxable sales accurately.

- On Line 3, list any exempt state sales and other deductions you are claiming. This may include specific exemptions as outlined in instructions.

- Calculate your total taxable sales and enter the result on Line 4, following the formula: Line 1 plus Line 2 minus Line 3.

- Complete Line 5 by entering your qualifying food sales, then calculate the tax by multiplying by the rate of 1.5%.

- For Line 6, enter general taxable sales and compute tax by multiplying by the rate of 4.3%. Add this to the previous lines to calculate total state taxes.

- Calculate any dealer discounts on Line 8 based on the criteria outlined. This discount applies only if returns are filed timely.

- Document any additional regional taxes for Northern Virginia or Hampton Roads in Lines 10a and 10b, entering your taxable sales and determining taxes based on the regional rates.

- For local tax, enter your local taxable sales on Line 12 and multiply by the relevant local tax rate.

- Assemble total taxes and fees in Line 15 by adding applicable charges. Ensure this is accurate to avoid penalties.

- In the declaration section, sign and date the form to validate your submission. This confirms the accuracy of your reported information.

- Finally, save your changes, and download, print, or share the completed form as needed for your records.

Complete your forms online today to ensure accurate and timely submission!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a tax certificate from the IRS, submit Form 4506-T, Request for Transcript of Tax Return, or contact the IRS directly. Ensure you have your tax information ready for a smooth process. Remember, the use of the VA DoT ST-9 & ST-9A forms may be beneficial if you're using IRS documentation to support your tax-exempt status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.