Get Va Dot St-13a 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VA DoT ST-13A online

How to fill out and sign VA DoT ST-13A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

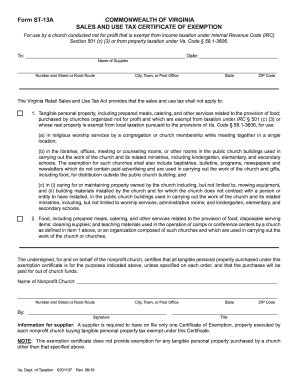

Completing tax documentation can turn into a significant obstacle and intense frustration if there is no suitable assistance provided. US Legal Forms has been established as a web-based solution for VA DoT ST-13A e-filing and offers numerous benefits for taxpayers.

Utilize the guidelines on how to complete the VA DoT ST-13A:

Employ US Legal Forms to guarantee a convenient and straightforward process for filling out the VA DoT ST-13A.

- Obtain the template online in the specific section or through the search engine.

- Press the orange button to access it and wait for it to load.

- Review the template and focus on the instructions. If you have never filled out the template before, adhere to the step-by-step guidance.

- Pay attention to the highlighted fields. These are editable and require specific information to be entered. If you are unsure what information to provide, refer to the guidelines.

- Always sign the VA DoT ST-13A. Utilize the integrated tool to create the e-signature.

- Select the date field to automatically input the appropriate date.

- Review the sample to verify and edit it before the e-filing.

- Press the Done button in the top menu once you have completed it.

- Save, download, or export the finished form.

How to modify Get VA DoT ST-13A 2016: personalize forms online

Locate the appropriate Get VA DoT ST-13A 2016 template and adjust it immediately.

Streamline your documentation with an intelligent document modification tool for online forms.

Your everyday processes with documentation and forms can be more efficient when you have all necessary resources in one location. For example, you can discover, acquire, and alter Get VA DoT ST-13A 2016 within just a single browser tab.

If you require a particular Get VA DoT ST-13A 2016, it is easy to locate it utilizing the smart search feature and access it right away. You don't need to download it or search for an external editor to change and input your details. All the elements for productive work come in just one integrated solution.

Enhance your custom modifications with available resources.

- This alteration solution allows you to personalize, complete, and endorse your Get VA DoT ST-13A 2016 form directly on the spot.

- Once you locate a suitable template, click on it to enter the editing mode.

- Once you access the form in the editor, you have every vital tool at your disposal.

- You can easily fill in the specified fields and remove them if needed with the aid of a straightforward yet versatile toolbar.

- Implement all changes immediately, and sign the document without exiting the tab by simply clicking the signature area.

Related links form

The income level exempt from taxes in Virginia depends on multiple factors such as filing status and personal exemptions. Generally, lower income levels may qualify for tax exemptions, thereby reducing taxable income. For more precise information, refer to the VA DoT ST-13A and consider discussing your case with a tax professional.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.