Loading

Get Va Dot R-5e 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT R-5E online

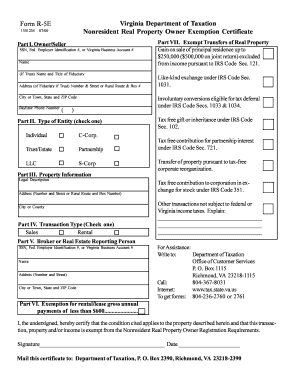

The Virginia Department of Taxation Nonresident Real Property Owner Exemption Certificate, known as form R-5E, is essential for property owners who meet specific criteria for tax exemption. This guide will provide a clear and supportive walkthrough of how to fill out this form online effectively.

Follow the steps to complete the VA DoT R-5E form

- Click the ‘Get Form’ button to access the VA DoT R-5E and open it in the designated online editor.

- In Part I, fill in the owner or seller information. This section requires your Social Security Number (SSN), Federal Employer Identification Number (EIN), or Virginia Business Account Number, followed by your name, and if applicable, the name and title of the fiduciary for trusts. Include the address with number and street, city or town, state, ZIP code, and your daytime phone number.

- Move to Part II and indicate the type of entity by checking the appropriate box. Options include individual, C-Corporation, Trust/Estate, Partnership, Limited Liability Company (LLC), or S-Corporation.

- In Part III, provide the property information. You will need to enter the legal description of the property, including the address, city or county.

- Proceed to Part IV and select the transaction type by checking either sales or rental.

- In Part V, complete information regarding the broker or real estate reporting person, including the required SSN, EIN, or Virginia Business Account Number, along with the name and address.

- Part VI allows for exemptions related to transactions. Check the appropriate exemptions that apply to your situation, including gross annual payments for rental/lease under $600 or any other applicable exemptions.

- In the designated section of Part VI, provide explanations for any other transactions that may not be subject to federal or Virginia income taxes, if applicable.

- After completing all sections, sign and date the certificate at the bottom, verifying that the conditions cited apply to the property described.

- Finally, save your changes, and download or print the completed form. Ensure to mail it to the Department of Taxation at the specified address.

Complete your VA DoT R-5E form online today and ensure your tax exemption is processed smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can obtain VA tax forms, including the VA DoT R-5E, through the Virginia Department of Taxation website. You may also find these forms at local tax offices or certain financial institutions. It is advisable to download the most current version directly from the official website to ensure compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.