Get Va Dot Pte 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VA DoT PTE online

How to fill out and sign VA DoT PTE online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can become a significant issue and a major inconvenience if proper assistance is not provided. US Legal Forms has been created as an online solution for VA DoT PTE e-filing and offers multiple benefits for taxpayers.

Utilize the guidance on how to complete the VA DoT PTE:

Leverage US Legal Forms to ensure a secure and straightforward completion of the VA DoT PTE.

- Access the form on the website in the designated section or through a search engine.

- Select the orange button to open it and wait for it to load.

- Examine the form and pay close attention to the instructions. If you have never filled out the sample before, follow the step-by-step directions.

- Focus on the highlighted fields. They are fillable and require specific information to be entered. If you're uncertain about what to input, consult the instructions.

- Always sign the VA DoT PTE. Use the built-in tool to create your electronic signature.

- Click the date field to automatically populate the correct date.

- Review the document to make any necessary adjustments before submission.

- Click the Done button in the upper menu once finished.

- Save, download, or export the completed document.

How to Modify Get VA DoT PTE 2015: Tailor Forms Online

Eliminate clutter from your documentation routine. Uncover the easiest method to locate, alter, and submit a Get VA DoT PTE 2015 form.

The task of preparing Get VA DoT PTE 2015 requires accuracy and focus, particularly for those who are not well acquainted with such work. It is vital to acquire an appropriate template and complete it with the correct details. With the right tools for document management, you can have all necessary resources at your disposal.

It's straightforward to simplify your editing process without acquiring new skills. Find the correct example of Get VA DoT PTE 2015 and complete it promptly without toggling between browser tabs. Explore additional tools to modify your Get VA DoT PTE 2015 form in the editing mode.

When on the Get VA DoT PTE 2015 page, simply hit the Get form button to commence adjustments. Enter your information into the form immediately, as all crucial tools are available right here. The template is pre-structured, so the user's effort is minimized. Just utilize the interactive fillable fields in the editor to efficiently finalize your documentation. Click on the form and transition to the editor mode instantly. Complete the interactive fields, and your document is prepared.

Often, a minor mistake can compromise the entire form when filled by hand. Eliminate inaccuracies in your documentation. Quickly find the templates you need and complete them digitally using an efficient editing solution.

- Add additional text around the document as necessary.

- Utilize the Text and Text Box tools to insert text in a separate container.

- Incorporate pre-designed graphic elements like Circle, Cross, and Check using the respective tools.

- If desired, capture or upload images to the document with the Image tool.

- If you wish to draw something on the document, use Line, Arrow, and Draw tools.

- Employ the Highlight, Erase, and Blackout tools to adjust the text in the document.

Get form

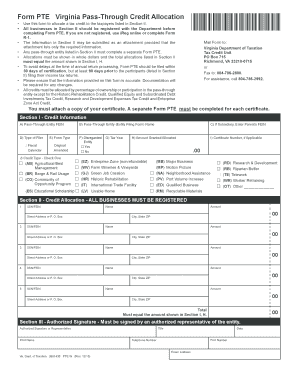

VA Form 502 is the state tax form for partnerships that have elected to file taxes at the entity level under the VA DoT PTE system. This form helps report income, deductions, and tax liabilities of the partnership itself rather than its individual partners. Proper completion of this form is essential for compliance and can impact overall tax obligations. For efficient form preparation, consider using the tools that USLegalForms offers.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.