Loading

Get Va Dot 760py 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760PY online

Completing the VA DoT 760PY form online can simplify your tax filing process. This guide will walk you through each section and detail the necessary steps to ensure accuracy and compliance.

Follow the steps to successfully complete the VA DoT 760PY online.

- Click ‘Get Form’ button to access the VA DoT 760PY form and open it in your online editor.

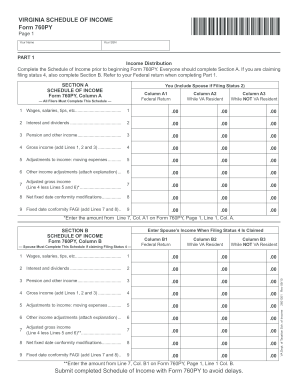

- Begin with Part 1, Section A titled 'Schedule of Income'. Here, you will need to enter your income details, such as wages, interest, and pension income. Ensure you include figures from your federal return in Column A1 for all filers.

- If claiming filing status 4, proceed to Section B in Part 1 and enter your spouse's income details similar to how you filled out your own information. You will report amounts in Columns B1, B2, and B3 accordingly.

- Once you have completed Section A and Section B, calculate your adjusted gross income by subtracting any allowed adjustments from your gross income.

- Next, navigate to Part 2 to complete the Prorated Exemptions Worksheet. This worksheet calculates your eligible personal and dependent exemptions based on the time you resided in Virginia. Follow the instructions to determine your prorated exemption amount.

- Lastly, fill out Part 3, which collects moving information if applicable. Provide details such as the state of your prior residence before moving into Virginia and any moves made out of the state.

- After completing all sections of the form, be sure to review your entries for accuracy. You can save changes, download a copy, print, or share the form as necessary.

Complete your VA DoT 760PY form online today to streamline your tax filing process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Virginia form 770 is a tax return specifically for high-income individuals and is designed for those filing under the Personal Property Tax Relief Act. This helps filers report eligible income accurately for state taxes. If you also need to consider part-year residency, the VA DoT 760PY will apply here, ensuring you meet all requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.