Loading

Get Va Dot 760py 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760PY online

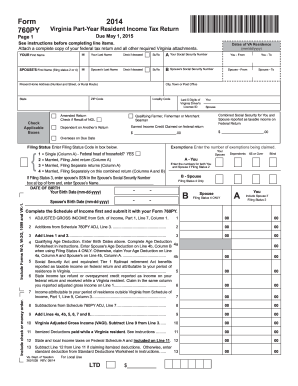

The Virginia Part-Year Resident Income Tax Return, Form 760PY, is essential for individuals who have lived in Virginia for part of the tax year. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the VA DoT 760PY online effectively.

- Click the ‘Get Form’ button to access the VA DoT 760PY. This will open the form in an online editor where you can begin filling it out.

- Complete the personal information section by entering your last name, first name, and social security number. If applicable, enter your spouse's information as well.

- Provide your current home address, locality code, and check any boxes that apply to your tax situation, such as 'Amended Return' or 'Filing as Dependent'.

- Indicate your filing status by entering the appropriate code in the designated box, such as single or married filing jointly.

- Fill out the income information section. Include wages, interest, and any other income sources. Make sure to attach any necessary forms like W-2s or 1099s.

- Calculate your deductions and taxable income. Refer to the provided worksheets and instructions to accurately calculate the amounts.

- Complete the tax calculations section to determine the amount of tax owed or the refund due.

- Review all entered information for accuracy before saving or printing the completed form.

- Once you have finalized your form, you can save changes, download it, print for your records, or share it as needed.

Start filling out your VA DoT 760PY online today for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can pick up Virginia state tax forms at various public facilities, including local tax offices and library branches. Additionally, many local retailers offer tax preparation supplies. For complete convenience, consider downloading the VA DoT 760PY directly from the Virginia Department of Taxation’s website and printing it at home.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.