Loading

Get Va Dot 760es 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760ES online

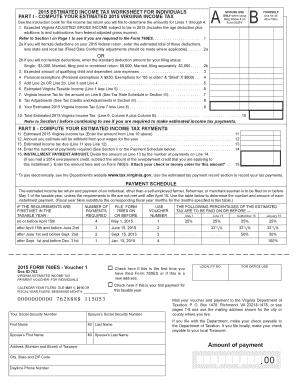

Filling out the VA DoT 760ES form online can be a smooth and straightforward process with the right guidance. This form is essential for individuals who need to make estimated income tax payments in Virginia and understanding how to navigate it can help ensure timely and accurate submissions.

Follow the steps to successfully complete the VA DoT 760ES form online.

- Click ‘Get Form’ button to obtain the VA DoT 760ES form and open it in the online editor.

- Begin by carefully reading the instructions provided with the form to understand your eligibility and the requirements for filing.

- Enter your identifying information, including your Social Security number and name, in the designated fields.

- Fill in your address details, including the street address, city, state, and ZIP code.

- Indicate whether this is your first time filing or if your address has changed by checking the appropriate box.

- Complete the estimated income tax worksheet to calculate your expected Virginia adjusted gross income for the year.

- Provide the amount of payment you are submitting based on your calculated tax due.

- If applicable, include your spouse’s information in the designated fields for joint filing.

- Review all entries for accuracy before proceeding to submit the form.

- Save your completed form, and download or print it as needed, ensuring you keep a copy for your records.

Take the next step and fill out your VA DoT 760ES online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A reasonable cause for penalty abatement in Virginia may include circumstances such as serious illness, natural disasters, or reliance on incorrect advice from a tax professional. If you believe your situation warrants consideration, submit proper documentation with your VA DoT 760ES form to request relief from penalties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.