Loading

Get Va Dot 760 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 760 online

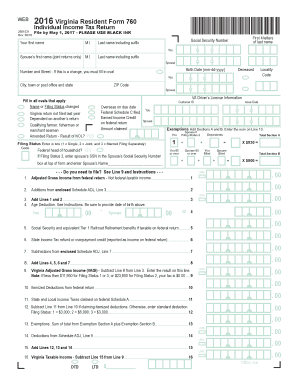

Filling out the VA DoT 760 form online can seem daunting, but with the right guidance, you can navigate each section with ease. This guide provides step-by-step instructions tailored for users with varying levels of experience.

Follow the steps to complete the VA DoT 760 form online.

- Click ‘Get Form’ button to access the VA DoT 760 form and open it in the designated tool.

- Begin by entering your personal information, including your first name, middle initial, last name (with any suffix), and the same details for your spouse if filing jointly. Provide your ZIP code for accurate processing.

- Fill out the Virginia Driver’s License Information section. Indicate if any applicable ovals like name or filing status changes, or if you were overseas on the due date.

- Declare your filing status by entering the appropriate number indicating whether you are single, filing jointly, or married filing separately.

- List your income details in Section A. Enter the adjusted gross income from your federal return, and provide information about any applicable deductions and credits such as the age deduction if applicable.

- Continue to Section B and detail any additional income and deductions, such as Social Security benefits and state tax refunds.

- Calculate your Virginia Adjusted Gross Income (VAGI) by subtracting your deductions from your total income as indicated in the form.

- Complete the Tax Calculation section where you will determine the amount of tax owed or any tax credit available based on the figures provided in previous sections.

- If applicable, indicate any tax payments already made and the desired method for receiving refunds, whether through direct deposit or check.

- Finally, review all entries carefully, then save your changes. You can download, print, or share the VA DoT 760 form as needed.

Start completing your VA DoT 760 form online today for a smooth and efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A Virginia partnership return must be filed by any partnership doing business in Virginia or having income derived from Virginia sources. Each partner is then responsible for reporting their share of the partnership’s income on their personal returns, including the VA DoT 760, if applicable. You can find helpful resources through uslegalforms for properly filing partnership returns.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.