Loading

Get Ca Ftb 593-e 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 593-E online

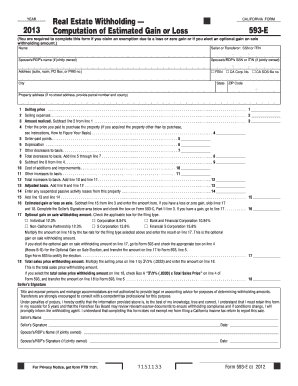

Filling out the CA FTB 593-E form is an important step for anyone claiming an exemption on real estate withholding due to a loss, zero gain, or for those electing an optional gain on sale withholding amount. This guide will provide you with a clear process to complete the form online efficiently.

Follow the steps to complete the CA FTB 593-E form online.

- Click ‘Get Form’ button to retrieve the CA FTB 593-E online and access it in the editor.

- Begin by entering your name and the seller or transferor's Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If the property is jointly owned, also provide your spouse's or registered domestic partner's name and their SSN or ITIN.

- Fill out the address section, which includes your complete address. This should include any suite, room, PO Box, or PMB number. Ensure you also include the city, state, and ZIP code.

- Provide details regarding the property including the address. If there is no street address available, enter the parcel number and county instead.

- Next, enter the selling price of the property on line 1. Follow this by filling in the selling expenses on line 2.

- Calculate the amount realized by subtracting line 2 (selling expenses) from line 1 (selling price) and input the result on line 3.

- On line 4, enter the purchase price of the property. If the property was acquired through means other than direct purchase, instructions are provided to help you calculate your basis.

- Continue to fill out the seller-paid points on line 5, followed by any depreciation on line 6.

- For line 7, document any other decreases to your basis before calculating the total decreases on line 8, which sums lines 5 through 7.

- On line 9, subtract the total decreases (line 8) from the original purchase price (line 4) to find your adjusted basis.

- Record the cost of additions and improvements on line 10 and any other increases to basis on line 11.

- Add lines 10 and 11 to get the total increases to basis and enter this amount on line 12.

- Combine your adjusted basis and total increases to basis on line 13.

- Report any suspended passive activity losses from the property on line 14 and sum this with your total on line 13 to enter the result on line 15.

- To determine your estimated gain or loss on sale, subtract line 15 from line 3 and enter the result on line 16.

- If you elect to calculate an optional gain on sale withholding amount based on your gain, check the appropriate box for your filing type on line 17. Multiply the amount from line 16 by the corresponding tax rate and enter it on line 17.

- Alternatively, calculate the total sales price withholding amount by multiplying the selling price on line 1 by 3.33% and record this on line 18.

- Finally, review all entered information for accuracy, then proceed to save your changes, download, print, or share the completed form as needed.

Complete your documents online now.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In California, an exemption from withholding means that employers do not deduct state income tax from an employee's wages. This can apply to individuals who expect to owe no tax or whose tax credits equal their tax liability for the year. It’s essential to appropriately use the CA FTB 593-E to help affirm your exemption status and communicate this to your employer.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.