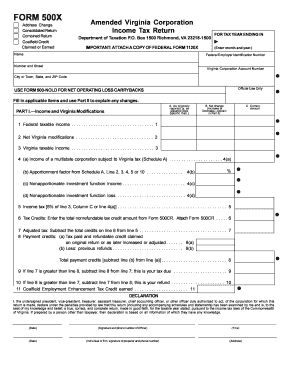

Get Va Dot 500x 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VA DoT 500X online

How to fill out and sign VA DoT 500X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing tax forms can become a significant obstacle and a major nuisance if adequate support is not available.

US Legal Forms is designed as an online solution for VA DoT 500X electronic filing and provides numerous benefits for taxpayers.

Use US Legal Forms to ensure a secure and straightforward VA DoT 500X completion.

- Obtain the template from the website within the specific section or through the Search engine.

- Click the orange button to open it and wait for it to load.

- Examine the blank form and pay attention to the guidelines. If you have never filled out the sample before, follow the instructions line by line.

- Pay attention to the highlighted fields. These are editable and require specific information to be entered. If you're unsure what information to input, refer to the instructions.

- Always sign the VA DoT 500X. Utilize the built-in tool to create your electronic signature.

- Click on the date field to automatically insert the correct date.

- Review the sample to verify and edit it before submitting.

- Press the Done button in the upper menu when you have finished.

- Save, download, or export the completed template.

How to alter Get VA DoT 500X 2000: personalize forms online

Eliminate the clutter from your documentation routine. Uncover the simplest method to locate, modify, and submit a Get VA DoT 500X 2000.

The task of preparing Get VA DoT 500X 2000 requires precision and focus, particularly from those who are not very acquainted with this kind of assignment. It is crucial to obtain an appropriate template and fill it with accurate details. With the proper method for handling documentation, you can have all the tools you need readily available. It's easy to streamline your editing process without acquiring new skills. Identify the correct sample of Get VA DoT 500X 2000 and complete it promptly without toggling between your browser tabs. Explore additional tools to personalize your Get VA DoT 500X 2000 form in the editing mode.

While on the Get VA DoT 500X 2000 page, just click the Get form button to begin altering it. Input your information directly into the form, as all necessary tools are conveniently located right here. The sample is pre-fabricated, so the user's effort is reduced. Utilize the interactive fillable fields in the editor to easily finalize your paperwork. Simply click on the form and proceed to edit mode without delay. Fill in the interactive field, and your document is ready to go.

Often, a minor mistake can sabotage the entire form when someone fills it out manually. Eliminate inaccuracies in your paperwork. Locate the templates you require within moments and complete them electronically using a smart editing solution.

- Insert additional text around the document if required. Use the Text and Text Box tools to add content in a separate box.

- Incorporate pre-made graphic components like Circle, Cross, and Check with the respective tools.

- If necessary, capture or upload visuals to the document using the Image option.

- If you need to sketch something in the document, utilize Line, Arrow, and Draw tools.

- Employ the Highlight, Erase, and Blackout tools to modify the text within the document.

- If comments are needed on particular document sections, click on the Sticky tool and add a note where desired.

Get form

Related links form

Claiming 0 on VA 4 means more tax will be withheld, potentially resulting in a tax refund at the end of the year. Conversely, claiming 1 may reduce your withholding but could lead to owing taxes. The VA DoT 500X offers guidance on how to assess your situation, allowing you to make an informed decision.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.