Loading

Get Ca Ftb 593-e 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 593-E online

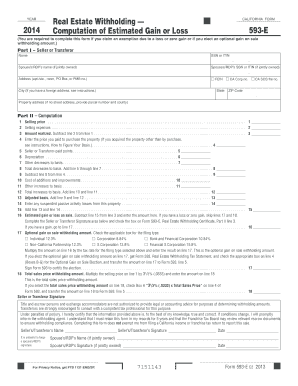

Filling out the CA FTB 593-E form is essential for sellers or transferors claiming an exemption due to a loss or zero gain when selling real estate. This guide will assist you in navigating the online filling process to ensure a smooth and accurate submission.

Follow the steps to fill out the CA FTB 593-E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I by entering the seller or transferor's name, social security number (SSN) or individual taxpayer identification number (ITIN), and address. If applicable, include the spouse or registered domestic partner's details.

- In Part II, enter the selling price on line 1. This is the total amount you will receive for the property, including any debt the buyer assumes.

- For line 2, provide the selling expenses such as commissions and fees that will be paid by you.

- Calculate the amount realized by subtracting the selling expenses (line 2) from the selling price (line 1) and enter it on line 3.

- Enter the purchase price of the property on line 4. This includes your down payment and any debt incurred during the acquisition.

- If any points were paid to obtain the loan, enter that amount on line 5.

- On line 6, enter the depreciation amount you deducted, or could have deducted, on your California income tax return for business or investment use.

- On lines 7-9, account for any other decreases (line 7) and calculate the total decreases to basis (line 8) by adding lines 5 through 7, then enter the result on line 9.

- For increases to basis, add costs of additions or improvements to the property on lines 10-12, entering totals accordingly.

- Calculate the adjusted basis on line 13 by adding lines 9 and 12.

- Report any suspended passive activity losses on line 14, if applicable, and complete the addition on line 15.

- Calculate the estimated gain or loss on sale on line 16 by subtracting line 15 from line 3, and complete any additional fields for optional withholding amounts.

- Finally, review the form for accuracy and complete the seller or transferor's signature area below, ensuring to retain this form for your records.

Get started on filling out the CA FTB 593-E online today to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The number of California withholding allowances to claim depends on your personal financial circumstances. You should consider factors such as your filing status, dependents, and expected year-end tax obligations. Using the CA FTB 593-E form can help clarify what is appropriate for your situation, ensuring you have the correct withholding to meet your financial goals.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.