Loading

Get Va 502w 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 502W online

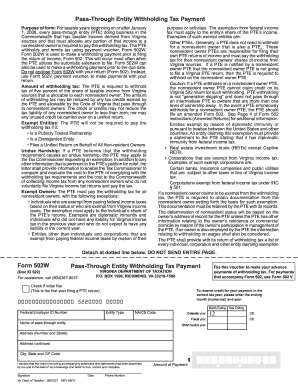

Filling out the VA 502W form is an essential process for pass-through entities to remit withholding tax on behalf of nonresident owners. This guide will assist you in completing the form accurately and efficiently, ensuring compliance with Virginia tax regulations.

Follow the steps to complete the VA 502W form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your federal employer identification number (FEIN) in the designated field at the top of the form.

- Select the entity type by entering the appropriate code corresponding to your entity's classification (e.g., SC for S corporation, PG for general partnership).

- Fill in the NAICS code, which is a 6-digit code that identifies your business activities. Ensure that you use a valid code available from the Virginia Department of Taxation.

- Indicate the ending month and year for the withholding tax payment, ensuring accuracy to receive proper tax year credit.

- Provide the name and address of the pass-through entity, including any additional address lines and the city, state, and ZIP code.

- Calculate the amount of withholding tax due based on the taxable income derived from Virginia sources and the applicable nonresident owner shares. Enter this total in the amount of payment field.

- Review the declaration statement, ensuring all information is true and correct, then sign and date the form.

- Enter your phone number in the space provided for any follow-up questions related to your submission.

- After completing the form, you may save your changes, download the form, print it, or share it as needed for your records.

Complete your VA 502W form online to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file an extension for Virginia state taxes, complete Form 763 and submit it by the original due date of your tax return. This form allows for an extension of up to six months to file your return. However, keep in mind that any taxes owed are still due on the original filing date. Using USLegalForms can make this process simpler, ensuring you meet all requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.