Get Va 502w 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 502W online

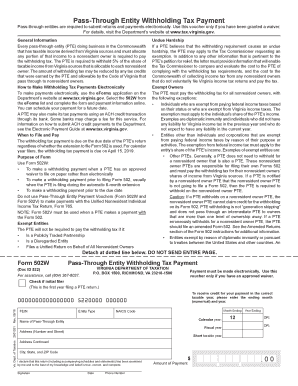

Filling out the VA 502W form online is a straightforward process that ensures compliance with Virginia's pass-through entity withholding tax requirements. This guide will provide you with detailed, step-by-step instructions for completing the form accurately and efficiently.

Follow the steps to fill out the VA 502W form effectively.

- Click the ‘Get Form’ button to obtain the VA 502W form and open it in your preferred online format.

- Enter your Federal Employer Identification Number (FEIN) in the designated field to identify your pass-through entity.

- Select the entity type from the dropdown menu, making sure to choose the correct code that corresponds with your entity (e.g., SC for S Corporation or PG for General Partnership).

- Provide the North American Industry Classification System (NAICS) code by entering the six-digit number in the specified area.

- Indicate the month and year your tax period ends by selecting the appropriate numerical values.

- Fill in the name of the pass-through entity and its primary address, ensuring all information is accurate and complete.

- Calculate the total amount of withholding tax owed by either computing the taxable income and applying the appropriate percentage for each nonresident owner or by determining each owner's income separately.

- Enter the total amount withheld in the dedicated block that indicates the payment amount.

- Review your entries for accuracy before signing and dating the form, and make sure to include your contact phone number in the provided space.

- Finally, save your changes, download a copy of the form, print it if necessary, or share it electronically as required.

Begin filling out your VA 502W form online today to meet your tax obligations efficiently.

Get form

Related links form

To mail your VA form 502, send it to the appropriate Virginia Department of Taxation address that corresponds with your type of filing. Ensure you follow the instructions printed on the form for correct mailing to avoid processing delays. If you need assistance with this process, uLegalForms can provide guidance and resources to ensure your forms reach the right destination smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.