Loading

Get Ca Ftb 593-e 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 593-E online

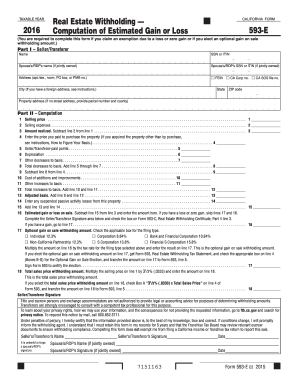

The CA FTB 593-E form is essential for estimating the gain or loss from real estate transactions for withholding purposes. This guide provides clear, step-by-step instructions on how to complete the form accurately and confidently.

Follow the steps to fill out the CA FTB 593-E form online.

- Click the 'Get Form' button to obtain the form and open it in your preferred online editor.

- In Part I, enter the names, social security numbers (SSNs) or individual taxpayer identification numbers (ITINs), and addresses of the seller/transferor, including a spouse or registered domestic partner if jointly owned.

- In Part II, begin the computation by entering the selling price of the property on line 1. This should be the total amount expected from the sale.

- Next, enter the selling expenses on line 2. Include all costs such as commissions, advertising fees, and any legal fees.

- On line 3, calculate the amount realized by subtracting the selling expenses (line 2) from the selling price (line 1).

- On line 4, enter the purchase price of the property. This may include your down payment and any debts incurred.

- Fill out line 5 with the amount of seller/transferor-paid points, if applicable. Points are fees paid to obtain a loan.

- Complete line 6 by entering the total depreciation taken on the property during the period it was held, or the depreciation you could have taken.

- Add any other decreases to your basis for line 7, such as casualty loss deductions or energy credits.

- On line 8, calculate the total decreases by summing lines 5 through 7.

- Subtract the total decreases in line 8 from the purchase price in line 4 to get the adjusted basis on line 9.

- Complete lines 10 to 15 with any costs of additions and improvements, other increases, and any suspended passive activity losses.

- For line 16, calculate the estimated gain or loss by subtracting line 15 from line 3. If there is a loss or zero gain, proceed accordingly.

- If opting for the gain on sale withholding, complete line 17 by selecting the appropriate tax rate and multiplying it by the gain on line 16.

- On line 18, provide the total sales price withholding amount by multiplying the selling price on line 1 by 31/3%.

- Lastly, ensure you sign and date the form, retaining a copy for your records, and consider seeking advice from a tax professional if necessary. You can now save changes, download, print, or share the completed form.

Complete your CA FTB 593-E document online today for smooth processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

No, the California Franchise Tax Board (CA FTB) and the Internal Revenue Service (IRS) are distinct entities. The IRS handles federal tax matters, while the CA FTB is focused on state tax issues in California. Understanding the difference is crucial for managing your tax responsibilities correctly. You can find separate guidelines for both on their respective websites.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.