Loading

Get Ut Ustc Tc-941 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-941 online

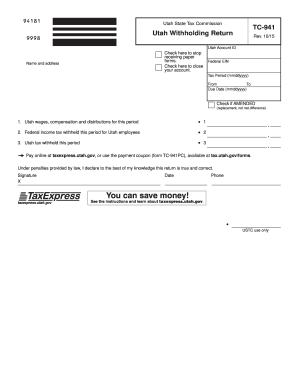

Filling out the UT USTC TC-941 online is an essential step for reporting Utah withholding tax accurately. This guide provides a clear overview of each section of the form, ensuring you understand the necessary steps for completion.

Follow the steps to complete your UT USTC TC-941 form.

- Click the ‘Get Form’ button to access the UT USTC TC-941 form and open it in your preferred online editor.

- Enter your Utah Account ID in the designated field at the top of the form to identify your account accurately.

- Provide your Federal Employer Identification Number (EIN) in the specified field. This information must match the EIN on your federal tax filings.

- Indicate the tax period by filling in the 'From' and 'To' dates using the format mmddyyyy, ensuring you include the correct timeframe for your tax report.

- Fill out the Due Date field using the mmddyyyy format. This is the deadline for your tax payment.

- If you are amending a previously filed return, check the box for 'AMENDED' located on the form. This will notify the tax commission of your intention to revise your submission.

- Report the total Utah wages, compensation, and distributions for this period in the space provided. This includes wages paid to employees working in Utah and any applicable 1099 payments.

- Enter the total federal income tax withheld for Utah employees during the specified period in the corresponding section.

- Input the amount of Utah tax withheld this period on the wages reported in the previous step.

- After completing the form, review all entered information for accuracy. You can then save your changes, download the document, and print or share it as necessary.

Get started now by completing your UT USTC TC-941 form online for a smooth filing experience.

Related links form

Yes, Utah requires estimated tax payments for individuals who expect to owe tax of $1,000 or more when filing their returns. This helps taxpayers avoid underpayment penalties throughout the year. Understanding how estimated taxes work is essential, especially when preparing your UT USTC TC-941 to stay compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.