Loading

Get Ut Ustc Tc-922 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-922 online

Filling out the UT USTC TC-922 tax return form can seem overwhelming, but with this comprehensive guide, you'll navigate the process with ease. This guide provides clear, step-by-step instructions tailored for users of all experience levels.

Follow the steps to complete the UT USTC TC-922 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

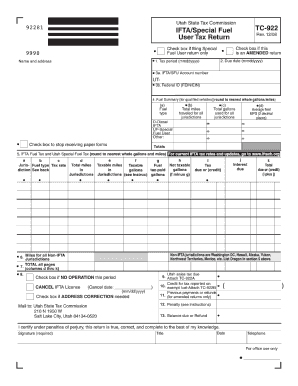

- Enter the tax period in the format mmddyyyy. This refers to the current quarterly period for which you are filing.

- Input the due date in mmddyyyy format. This is typically the last day of the month following the end of the quarter.

- Provide your IFTA/Special Fuel User account number, which is your IFTA license number.

- Fill in the federal ID number (FEIN/EIN) assigned by the federal government.

- Complete the fuel summary for qualified vehicles. List fuel types, total gallons, total miles, and the average fleet MPG as per instructions.

- For the IFTA fuel tax and Utah special fuel tax section, enter each jurisdiction, fuel type, tax rate, total miles, taxable miles, taxable gallons, and fuel tax-paid gallons in the corresponding columns.

- If applicable, check the box indicating no operation for this period or to cancel your IFTA license.

- Attach any required additional forms, such as TC-922A or TC-922B, and calculate any penalties or balances due.

- Review the entire form for accuracy, then proceed to save changes, download, print, or share the form as needed.

Complete your UT USTC TC-922 tax return online today for a smoother process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The W8BEN form should be filled out by non-U.S. citizens or non-resident aliens who receive income from U.S. sources. This form allows individuals and entities to claim tax treaty benefits or prove their foreign status. By using uslegalforms, you can efficiently complete the W8BEN form and ensure compliance with the guidelines surrounding the UT USTC TC-922.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.