Loading

Get Ut Ustc Tc-922 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-922 online

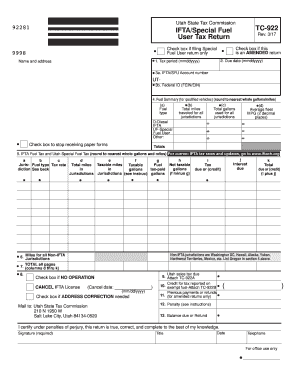

The UT USTC TC-922 form is essential for filing IFTA and special fuel user tax returns in Utah. This guide will help you navigate the process of completing the form online, ensuring you provide accurate information required by the Utah State Tax Commission.

Follow the steps to complete your UT USTC TC-922 online.

- Click the ‘Get Form’ button to access the TC-922 form and open it in the designated editor.

- Enter the tax period by selecting the relevant dates in the format mmddyyyy for the current quarterly period.

- Provide the due date for the submission, which is the last day of the month following the end of the tax period.

- Input your IFTA/Special Fuel User account number as assigned by the Utah State Tax Commission.

- Add your Federal ID number (FEIN/EIN) to ensure correct identification.

- Complete the fuel summary section. Enter total miles traveled and total gallons used for all jurisdictions. Calculate average fleet MPG for each type of fuel used.

- Fill out the IFTA Fuel Tax and Utah Special Fuel Tax sections, ensuring all taxable miles and gallons are accurately reported per jurisdiction.

- Indicate whether there are non-IFTA jurisdictions involved, and specify total miles traveled in those areas.

- Check any applicable boxes regarding your return, such as if this is an amended return or if you wish to stop receiving paper forms.

- Review all entries for accuracy, then save the form's changes, download a copy, print it for your records, or share it as necessary.

Complete your UT USTC TC-922 form online today to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you do not fill out the W-8BEN form, you may face withholding taxes at the maximum rate applicable to your income. This could significantly increase your tax liabilities on U.S. source income. Completing the W-8BEN can result in tax savings, so it is wise to be informed about the UT USTC TC-922 guidelines to avoid unnecessary costs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.