Loading

Get Ut Ustc Tc-738 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-738 online

Filling out the UT USTC TC-738 form online can seem daunting, but this guide will walk you through each step of the process. Whether you're a business owner or an individual, our clear instructions will help ensure that your appeal is accurately submitted to the Utah State Tax Commission.

Follow the steps to complete your petition for redetermination.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

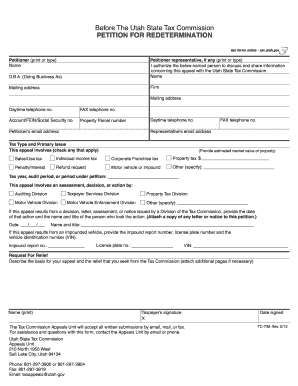

- Begin by providing your D.B.A. (Doing Business As) name, if applicable. This should reflect the business name under which you are operating.

- If you have a representative, fill in their details in the 'Petitioner representative' section. This includes their name, mailing address, firm, and check the authorization box that allows them to discuss your appeal.

- In the 'Petitioner' section, print or type your full name, mailing address, daytime telephone number, FAX number, and your account number, FEIN, or social security number.

- Provide the property parcel number, along with the daytime and FAX telephone numbers of both you and your representative, if applicable.

- Indicate the tax type and primary issue pertinent to your appeal. Check all that apply, such as sales/use tax or property tax, and provide the estimated market value of the property, if relevant.

- Specify the tax year, audit period, or period under petition. Identify which division of the Tax Commission your appeal relates to, attaching copies of relevant documents if available.

- If applicable, provide the details of any assessments, decisions, or notices issued by a division of the Tax Commission, including the required dates and names.

- For vehicle-related appeals, complete the impound details section with the impound report number, license plate number, and vehicle identification number (VIN).

- Write a clear description of the basis for your appeal along with the relief you are seeking from the Tax Commission. Attach additional pages if you require more space.

- Finally, print your name, sign the form, and record the date signed. Ensure that all your details are accurate before submitting.

- Once completed, you can save changes, download, print, or share the form as needed to submit it to the Tax Commission.

Take action today and complete your UT USTC TC-738 form online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can get a sales tax refund if you meet specific criteria, such as overpayment or cancellation of a transaction. To start the process, ensure that you have all necessary documentation ready. For additional help, consider exploring US Legal Forms to manage your refund request effectively using UT USTC TC-738.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.