Loading

Get Ut Ustc Tc-721 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-721 online

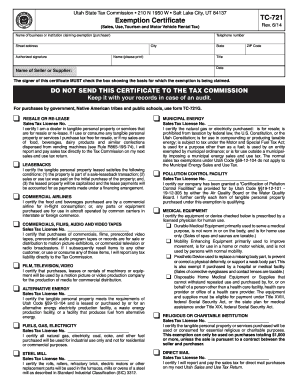

The UT USTC TC-721 is an exemption certificate used to claim exemptions from sales and use taxes in Utah. This guide provides a clear and structured approach to filling out the form online, ensuring users understand each component and can complete it accurately.

Follow the steps to complete the UT USTC TC-721 form online.

- Press the ‘Get Form’ button to access the UT USTC TC-721 form. This will allow you to open it in an online format for editing.

- Fill in the name of the business or institution claiming the exemption in the designated field at the top of the form.

- Designate the authorized signature by entering the name of the person signing the form. This must be printed clearly.

- Identify and enter the name of the seller or supplier from whom the exemption is being claimed.

- For fields requiring a sales tax license number, input this number where indicated to validate your exemption claim.

Complete your documents online today and ensure you're accurately managing your sales tax exemptions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Changing your tax status to exempt in Utah involves submitting the appropriate forms to the Utah State Tax Commission. This process will require documentation that supports your claim for exemption, as indicated in the UT USTC TC-721. By adhering to these guidelines, you can successfully update your tax status without complications.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.