Loading

Get Ut Ustc Tc-721 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-721 online

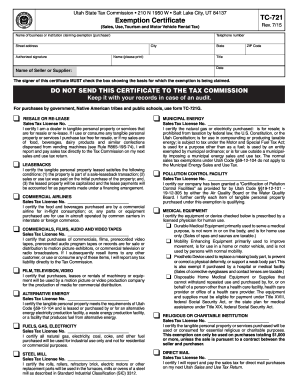

The UT USTC TC-721 is an exemption certificate used in the state of Utah for various sales and use tax exemptions. This guide provides clear and step-by-step instructions on how to accurately fill out this form online.

Follow the steps to complete the UT USTC TC-721 online.

- Click ‘Get Form’ button to access the exemption certificate and open it in your preferred editor.

- Enter the name of the business or institution claiming the exemption in the designated field.

- Provide the telephone number of the business or institution for contact purposes.

- Fill in the street address, city, state, and ZIP code of the business or institution.

- Ensure to print your name in the designated area, followed by your title.

- Include the date of completion in the provided field.

- Identify the name of the seller or supplier with whom the exemption is being claimed.

- Select the basis for the exemption by checking the appropriate box provided on the form.

- Review all entries to ensure accuracy before finalizing the form.

- Save changes, download, print, or share the completed form as necessary.

Complete your UT USTC TC-721 exemption certificate online for a smoother filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To register for sales tax in Utah, you must fill out the necessary forms, including the UT USTC TC-721 if applicable, directly through the state's tax agency. This registration enables you to collect sales tax on taxable sales and manage your business's tax responsibilities effectively. Completing this process is essential for compliance and ensuring you can operate within Utah's legal framework.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.