Loading

Get Ut Ustc Tc-721 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-721 online

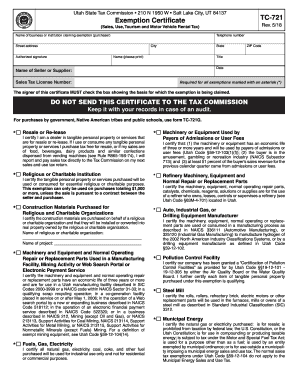

Filling out the UT USTC TC-721 form is essential for claiming tax exemptions in Utah. This guide will provide clear, step-by-step instructions to help you successfully complete the form online, ensuring you fulfill all necessary requirements.

Follow the steps to complete the UT USTC TC-721 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the name of the business or institution claiming the exemption in the designated field.

- Provide the telephone number, street address, city, state, and ZIP code of the business or institution.

- In the 'Authorized signature' section, print the name of the individual signing the form and include their title.

- Date the form in the provided field.

- Input the name of the seller or supplier and their sales tax license number.

- Check the box corresponding to the reason for the exemption claim, ensuring you fulfill the requirements for that exemption.

- Review all information for accuracy and completeness.

- Once you have filled out the form, save your changes, and choose the option to download, print, or share the completed form.

Complete your UT USTC TC-721 form online today to ensure your exemption claim is processed smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Utah sales tax is a tax applied to most goods and services sold within the state, with rates varying based on municipality. The state levies this tax at a base rate, which can be increased with local sales taxes. For a better understanding of how this affects your purchases, particularly regarding vehicles, reference the UT USTC TC-721. It offers insights into your obligations and possible exemptions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.