Loading

Get Ut Ustc Tc-20 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-20 online

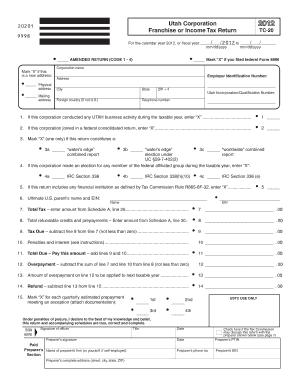

The UT USTC TC-20 form is essential for corporations in Utah to report their franchise or income tax. This guide will provide comprehensive, step-by-step instructions on how to complete the TC-20 online, ensuring a smooth and efficient filing process.

Follow the steps to fill out the TC-20 form accurately.

- Click 'Get Form' button to obtain the TC-20 form and open it in your online editor.

- Enter the calendar year or fiscal year in the designated field. Ensure the correct dates are input in the mm/dd/yyyy format.

- Indicate if this is an amended return by marking the appropriate box. Additionally, if you have filed federal Form 8886, mark this box as well.

- Fill in the corporation name and mark 'X' if the address has changed. Provide the Employer Identification Number (EIN) in the specified area.

- Input the physical and mailing addresses, including the city, state, and ZIP code. If applicable, include the foreign country.

- Provide the Utah incorporation or qualification number in the required field.

- Respond to questions regarding business activity and indicate if the corporation joined in a federal consolidated return.

- Complete the sections regarding tax amounts. Refer to Schedule A for specific figures, and ensure accuracy in entering refundable credits and tax due.

- Sign the form where indicated, including the signature of an officer, a preparer if applicable, and the date.

- Review the completed form for accuracy. Once satisfied, save changes, download, print, or share the form as needed.

Complete your TC-20 form online to ensure accurate and efficient tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can check the status of your Utah state tax refund online through the Utah State Tax Commission website. Simply input your details, such as Social Security number and refund amount. For a streamlined process, resources like UT USTC TC-20 can guide you on how to efficiently track your refund status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.