Loading

Get Ut Ustc Tc-20 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-20 online

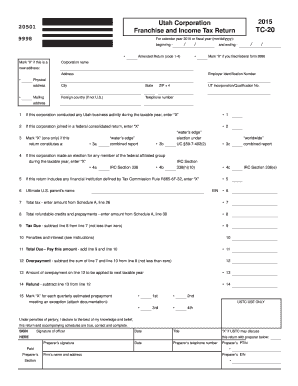

The UT USTC TC-20 form is essential for corporations to report franchise and income tax returns in Utah. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to easily complete your UT USTC TC-20 form online.

- Click ‘Get Form’ button to obtain the TC-20 form and open it in the editing platform.

- Enter the calendar year or fiscal year in the designated fields (mm/dd/yyyy) for the period of your return.

- Indicate if the return is an amended return by marking 'X' in the provided box.

- Fill in the corporation name, address, Employer Identification Number (EIN), and phone number as required.

- Complete the sections indicating whether the corporation conducted Utah business activities or joined a federal consolidated return, marking 'X' where applicable.

- Provide the total tax amount from Schedule A, line 26 and any refundable credits from Schedule A, line 30.

- Calculate the tax due by subtracting refundable credits from the total tax amount, ensuring it is not less than zero.

- Complete any additional sections relevant to financial institution definitions, penalties, and interest as instructed.

- Ensure all necessary signatures are completed, including that of an officer or preparer if applicable, and date the form.

- Once the form is completed, save your changes and choose to download, print, or share the form as needed.

Complete your UT USTC TC-20 form online today to ensure accurate tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, Utah imposes an underpayment penalty if you do not meet the required estimated tax payments. This penalty applies when taxpayers fall short of the minimum payment thresholds set by the Utah State Tax Commission. Understanding these regulations can help you manage your tax obligations more effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.