Loading

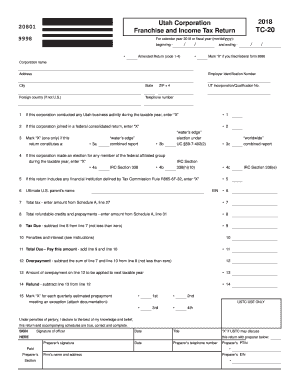

Get Ut Ustc Tc-20 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-20 online

Filling out the UT USTC TC-20 form can seem daunting, but this guide will provide you with clear, step-by-step instructions to help you through the process smoothly. Whether you are filing for a calendar or fiscal year, this guide aims to simplify each section of the form.

Follow the steps to complete the UT USTC TC-20 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your corporation name and address in the designated fields. Ensure that all information is accurate to avoid processing delays.

- Input your Employer Identification Number (EIN) and the state or foreign country of incorporation. Choose the type of return you are filing by marking the appropriate box for original or amended return.

- Indicate if your corporation conducted any business activity in Utah during the taxable year by marking ‘X’ in the corresponding field.

- Fill out the financial details, including total tax, refundable credits, and any penalties and interest, as specified in the designated lines.

- Sign and date the form in the officer signature section, ensuring you include your title.

- For those who used a preparer, complete the preparer's section with the required signature, date, and contact information.

- Review all entries for accuracy before finalizing. You can then save changes, download the completed form, print it, or share it as necessary.

Complete your UT USTC TC-20 form online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Utah's corporate tax rate is currently set at 4.95% of taxable income. This competitive rate applies to all corporations operating within the state. If you seek guidance on navigating the UT USTC TC-20 efficiently, USLegalForms offers resources that can assist you in understanding your tax responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.