Get Ut Ustc Tc-194a 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-194A online

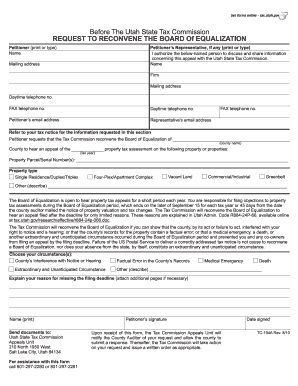

The UT USTC TC-194A is a form used to request reconvening the Board of Equalization regarding property tax assessments in Utah. This guide will provide you with clear, step-by-step instructions on how to complete the form effectively and accurately online.

Follow the steps to successfully complete the UT USTC TC-194A form.

- Press the ‘Get Form’ button to access the form. This will open the document in your preferred online editor.

- In the ‘Petitioner’ section, enter your name clearly, ensuring that it is printed or typed properly.

- If applicable, provide the name of the petitioner’s representative in the designated field. This person may assist in discussing the appeal with the Utah State Tax Commission.

- Fill in the mailing address of the petitioner and the representative. Include the firm’s name if represented by a firm.

- Provide daytime telephone numbers and fax numbers for both the petitioner and the representative.

- Enter the email addresses for the petitioner and the representative if available.

- Refer to your tax notice to fill out the county name where the property is located, and record the property tax assessment year.

- List the property parcel or serial number(s) associated with the property or properties being appealed.

- Select the type of property from the provided options, ensuring you accurately categorize the property.

- Choose the valid circumstance(s) that apply to your situation regarding why you missed the filing deadline.

- Explain your reason for missing the filing deadline in the space provided, including any necessary details. You may attach additional pages if required.

- Print your name clearly in the final section and provide your signature, along with the date signed.

- Once you have filled out all necessary sections, review the form for accuracy. Save your changes, download the completed form, and prepare it for mailing or submission.

Complete the UT USTC TC-194A form online today to ensure your property tax appeal is considered.

Get form

Related links form

To contact the Utah State Tax Commission, you can visit their official website or call their customer service line directly. They offer various resources and assistance for taxpayers, ensuring your questions are answered promptly. You can also reach out via email for specific inquiries. Using tools like uslegalforms can help you navigate the contact process and ensure your concerns are addressed effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.