Loading

Get Ut Tc-941pc 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-941PC online

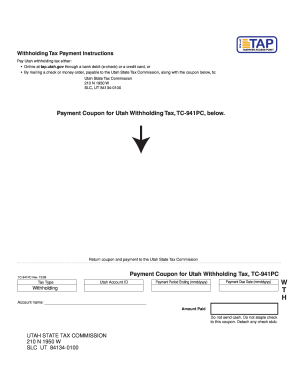

Filling out the UT TC-941PC online is a straightforward process that allows for efficient payment of withholding taxes. This guide provides clear steps to help you complete the form accurately and submit it without difficulty.

Follow the steps to complete the UT TC-941PC online.

- Press the ‘Get Form’ button to access the TC-941PC form and open it in your preferred online editor.

- Enter your Utah Account ID in the designated field to identify your tax account.

- Specify the payment period ending date using the format mmddyyyy, ensuring that you provide the correct cut-off date for which the tax payment applies.

- Indicate the payment due date in the same mmddyyyy format, noting that this date represents when your payment must be received.

- Fill in the account name associated with your withholding tax payments in the provided space.

- List the total amount you are paying for the reporting period, ensuring that the amount is correct as indicated on your records.

- Review all entries for accuracy, ensuring there are no errors before finalizing.

- Once completed, you can save your changes, download your form, print it for your records, or share it as necessary.

Access and complete your UT TC-941PC online today to ensure timely tax payment.

Typically, the employee is responsible for completing the withholding certificate. However, employers may provide guidance and resources to assist in filling out the form accurately. Ensuring this document is filled out correctly is crucial for compliance with the rules surrounding the UT TC-941PC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.