Get Ut Tc-55a 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-55A online

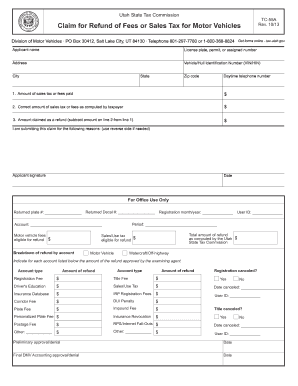

The UT TC-55A form is essential for claiming refunds of fees or sales tax related to motor vehicles in Utah. This guide will provide you with a clear and supportive walkthrough on how to complete the form online, ensuring you have all the information you need to submit your claim successfully.

Follow the steps to complete and submit your UT TC-55A claim.

- To begin, click the ‘Get Form’ button to access the form and open it in the editor.

- Enter the applicant name in the designated field. This should be the name of the person requesting the refund.

- Fill in the license plate, permit, or assigned number that corresponds to the vehicle for which you are requesting a refund.

- Provide your address, ensuring you include the city, state, and zip code to which any correspondence can be sent.

- Input the Vehicle/Hull Identification Number (VIN/HIN) accurately to identify the motor vehicle involved.

- Include your daytime telephone number, which may be used for any follow-up regarding your claim.

- In section 1, enter the total amount of sales tax or fees paid as this will form the basis of your claim.

- In section 2, calculate and input the correct amount of sales tax or fees as you believe should be applicable.

- Subtract the amount on line 2 from line 1 to determine the amount claimed as a refund, which should be entered in section 3.

- In the space provided, state the reasons for submitting this claim. You may use the reverse side of the form if necessary to provide additional details.

- Sign and date the form where indicated to certify your claim.

- After completing the form, ensure that all information is accurate, then save your changes. You can then download, print, or share the form as needed.

Complete your UT TC-55A form online today to request your motor vehicle refund.

Get form

Related links form

Registering to collect sales tax in Utah is a straightforward process that begins with applying for a sales tax license through the Utah State Tax Commission. You will need to provide basic details about your business, including legal structure and estimated sales. Utilizing the UT TC-55A form assists you in managing and remitting sales tax efficiently. A timely registration ensures you’re following state laws.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.