Get Ut Tc-49 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-49 online

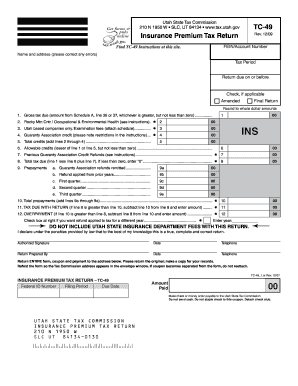

Filling out the UT TC-49, the insurance premium tax return form, can seem challenging at first. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently, ensuring you understand each section and its requirements.

Follow the steps to successfully complete your UT TC-49 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- In the initial section, enter your company name and address accurately. It is essential to verify that there are no errors in the details provided.

- Indicate the tax period and the return due date, ensuring you understand the deadlines to avoid possible penalties.

- Mark the appropriate checkboxes if this is an amended or final return. This will help the tax commission process your submission correctly.

- Proceed to section 1 to report the gross tax due, using the amount calculated from Schedule A, line 36 or 37.

- Complete lines 2 through 4 by entering values for any applicable credits, based on guidance from the form's instructions.

- Calculate the total credits on line 5 by adding the amounts from lines 2 through 4.

- On line 6, determine the allowable credits using the lesser amount between line 1 and line 5, ensuring it does not go below zero.

- Continue to fill in lines 7 and 8, noting previous guaranty association credit refunds and calculating the total tax due.

- Fill out section 9 for prepayments, detailing any prior tax payments or refunds that apply to the current return.

- Review all completed entries for accuracy and completeness before proceeding to finalize the form.

- Once you have filled out all necessary fields, save your changes, download the document, print it for your records, or share it as required.

Go ahead and fill out your UT TC-49 online today for a smooth tax filing experience.

Get form

Related links form

Utah state tax withholding is calculated based on the employee's earnings and the withholding allowances claimed on their W-4 form. Employers use specific tables provided by the Utah State Tax Commission to determine the appropriate withholding amount. Regular updates may take place, so staying informed is beneficial. Exploring resources and forms such as the UT TC-49 can provide additional clarity on changes in withholding regulations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.