Get Tx Trs 228a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TRS 228A online

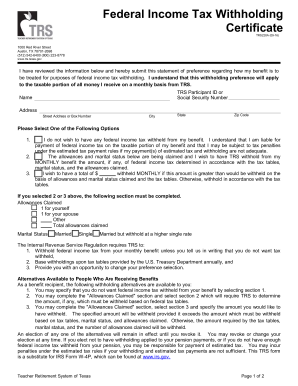

Filling out the TX TRS 228A form is an essential step for individuals seeking to manage their federal income tax withholding preferences for benefits from the Teacher Retirement System of Texas. This guide provides clear and detailed instructions to help users navigate the online completion of this important document.

Follow the steps to complete the TX TRS 228A online.

- Click ‘Get Form’ button to obtain the TX TRS 228A and open it in the editor.

- Enter your TRS Participant ID or Social Security Number in the designated field.

- Fill in your name, street address or box number, city, state, and zip code in the appropriate fields.

- Select one of the options regarding federal income tax withholding: 1. Indicate that you do not wish to have any federal income tax withheld. 2. Complete the 'Allowances Claimed' section by stating the number of allowances for yourself, spouse, and any others. 3. Specify a total dollar amount you wish to have withheld if it exceeds the calculated amount based on the previously mentioned criteria.

- Choose your marital status from the options provided: Married, Single, or Married but withhold at a higher single rate.

- Read and acknowledge the regulations concerning federal income tax withholding outlined by the Internal Revenue Service.

- Affix your signature and date the document to verify your submission.

- Once you have completed all sections, save your changes, and proceed to download, print, or share the form as needed.

Complete your TX TRS 228A form online today to ensure your federal income tax preferences are accurately set.

Get form

To upload documents to the Texas Teacher Retirement System, you can visit their official website and navigate to the document upload section. This process is important for keeping your records updated, especially when considering benefits related to TX TRS 228A. If you find the process challenging, uslegalforms offers simple solutions to assist you with document management.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.